The Bearing Steel Market is to Hit Its Bottom in July

Figure 1: Change in Domestic Output of Bearing Steel (crude steel) from 2011 to 2012

Data Resource: Special Steel Association

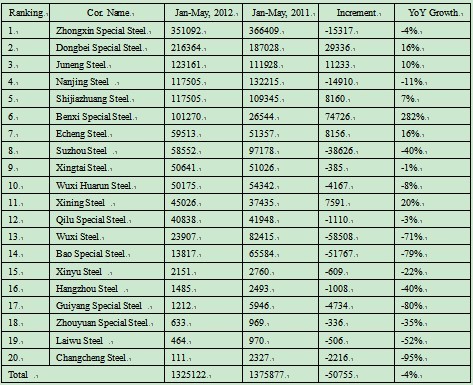

Table 1: Domestic Output of Crude Steel by Bearing Steel Manufacturers from January to April in 2012 (Unit: ton)

Figure 1: Change in Domestic Output of Bearing Steel (crude steel) from 2011 to 2012

Data Resource: Special Steel Association

Table 1: Domestic Output of Crude Steel by Bearing Steel Manufacturers from January to April in 2012 (Unit: ton)

Seen from Table 1 that the top three for bearing steel output from January to April in 2012 are still Zhongxin Special Steel (Xinye Steel and Xingcheng Special Steel), Dongbei Speical Steel and Juneng Steel, and the rankings of other steel mills do not change much (for Sha Steel, only the yield of Huai Steel counted).

II. Performance of Domestic Bearing Steel Market in Jun:

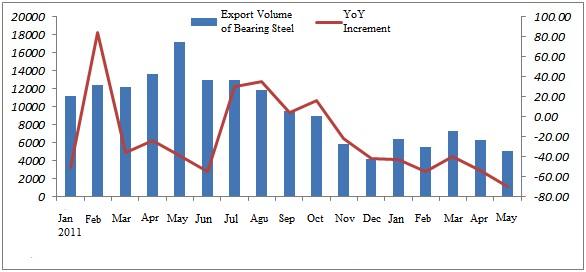

(i) The export volume of bearing steel from January to May in 2012 continued to fall

According to the statistical data released by the ten major domestic bearing steel manufacturers, the export volume of bearing steel in May was 5,068 ton, 70.4% declined compared with the same period of last year, and the accumulated export volume from January to May was only 25,453 ton. It is really worrying that the negative growth in the domestic bearing steel industry is getting worse since its first appearance in October last year.

Seen from Table 1 that the top three for bearing steel output from January to April in 2012 are still Zhongxin Special Steel (Xinye Steel and Xingcheng Special Steel), Dongbei Speical Steel and Juneng Steel, and the rankings of other steel mills do not change much (for Sha Steel, only the yield of Huai Steel counted).

II. Performance of Domestic Bearing Steel Market in Jun:

(i) The export volume of bearing steel from January to May in 2012 continued to fall

According to the statistical data released by the ten major domestic bearing steel manufacturers, the export volume of bearing steel in May was 5,068 ton, 70.4% declined compared with the same period of last year, and the accumulated export volume from January to May was only 25,453 ton. It is really worrying that the negative growth in the domestic bearing steel industry is getting worse since its first appearance in October last year.

Figure 2: Bearing Steel Export Situation in Major Domestic Special Steel Enterprises from 2011 to 2012

Data Resource: MRI

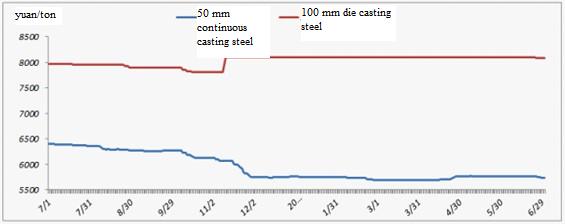

(ii) The price in the bearing steel market was slowly falling in Jun

The price in bearing steel market slightly went down in a slow falling trend. As entering the middle of the year, many traders have got the idea of withdrawing funds, however, the transaction situation is bad, coupled with the poor mentality, they tend to be negotiable about price. Though the market inventory was high, the volume was less, and the entire cargo operation cycle became longer, which put more pressure on the capital side. The detailed situations of bearing steel market across the country in Jun are as follows:

The price of bearing steels in Hangzhou market dropped and the market transactions performed bad. Up to the end of Jun, the average knock-down price of standard GCr15 continuous casting non-annealed steel was from 5,250 to 5,350 yuan/ton, and the average knock-down price of GCr15 die-casting annealed steel was around 7,600 yuan/ton.

The bearing steel price in Luoyang dropped and the deal was light. Up to the end of Jun, the average knock-down price of standard GCr15 continuous casting non-annealed steel was from 5,500 to 5,650 yuan/ton, and the average knock-down price of GCr15 die-casting annealed steel was between 7,600 and 7,700.

The price in Xi'an market slighly dropped and the deal was commom. Up to the end of Jun, the spot goods of standard GCr15 continuous casting non-annealed steel was relatively insufficient, and the average knock-down price of GCr15 die-casting annealed steel was from 7,700 to 7,750 yuan/ton.

As for Chongqing and Chengdu markets, the price was temporarily stable, and the turnover slightly slowed down. Up to the end of Jun, the average knock-down price of standard GCr15 continuous casting non-annealed steel was from 5950 to 6150 yuan/ton, and the average knock-down price of GCr15 die-casting annealed steel was around 7,600 yuan/ton.

Figure 2: Bearing Steel Export Situation in Major Domestic Special Steel Enterprises from 2011 to 2012

Data Resource: MRI

(ii) The price in the bearing steel market was slowly falling in Jun

The price in bearing steel market slightly went down in a slow falling trend. As entering the middle of the year, many traders have got the idea of withdrawing funds, however, the transaction situation is bad, coupled with the poor mentality, they tend to be negotiable about price. Though the market inventory was high, the volume was less, and the entire cargo operation cycle became longer, which put more pressure on the capital side. The detailed situations of bearing steel market across the country in Jun are as follows:

The price of bearing steels in Hangzhou market dropped and the market transactions performed bad. Up to the end of Jun, the average knock-down price of standard GCr15 continuous casting non-annealed steel was from 5,250 to 5,350 yuan/ton, and the average knock-down price of GCr15 die-casting annealed steel was around 7,600 yuan/ton.

The bearing steel price in Luoyang dropped and the deal was light. Up to the end of Jun, the average knock-down price of standard GCr15 continuous casting non-annealed steel was from 5,500 to 5,650 yuan/ton, and the average knock-down price of GCr15 die-casting annealed steel was between 7,600 and 7,700.

The price in Xi'an market slighly dropped and the deal was commom. Up to the end of Jun, the spot goods of standard GCr15 continuous casting non-annealed steel was relatively insufficient, and the average knock-down price of GCr15 die-casting annealed steel was from 7,700 to 7,750 yuan/ton.

As for Chongqing and Chengdu markets, the price was temporarily stable, and the turnover slightly slowed down. Up to the end of Jun, the average knock-down price of standard GCr15 continuous casting non-annealed steel was from 5950 to 6150 yuan/ton, and the average knock-down price of GCr15 die-casting annealed steel was around 7,600 yuan/ton.

Figure 3: Average Price Trend of Domestic Bearing Steel from 2011 to 2012

Data Resource: Mysteel

According to the statistics released at Mysteeel.com: up to the end of Jun, 2012, the average price of GCr15 Φ50mm continuous casting non-annealed steel in China was 5,732 yuan/ton; the average price of GCr15 Φ100mm die-casting annealed steel was 8,086 yuan/ton. (some modifications applied to the statistical method)

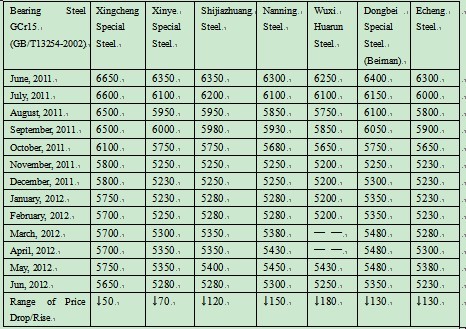

Table 2: Summary of Sales Price of Major Bearing Steel Manufacturers in East China (standard continuous casting non-annealed steel bar) Unit: yuan

Figure 3: Average Price Trend of Domestic Bearing Steel from 2011 to 2012

Data Resource: Mysteel

According to the statistics released at Mysteeel.com: up to the end of Jun, 2012, the average price of GCr15 Φ50mm continuous casting non-annealed steel in China was 5,732 yuan/ton; the average price of GCr15 Φ100mm die-casting annealed steel was 8,086 yuan/ton. (some modifications applied to the statistical method)

Table 2: Summary of Sales Price of Major Bearing Steel Manufacturers in East China (standard continuous casting non-annealed steel bar) Unit: yuan

Table 2 shows that the bearing steel price in East China dropped in Jun and the overall trend was "first rise and then fall", showing a certain increase compared with the beginning of the month.

III. Domestic Bearing Steel Market will Experience Vulnerable Consolidation:

1. Raw materials

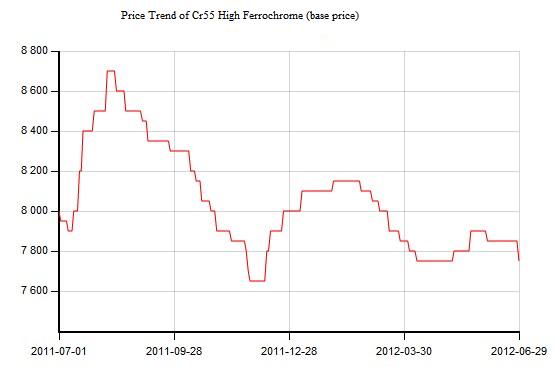

The high-chrome prices dropped in Jun, and the quoted price at the end of the month was around 7750 yuan/ton, 150 yuan/ton fell compared with last month, and returning to the low level in April and May. Though the market performance of iron ore and the like raw materials was a bit better than that of the steel market, the tendency was relatively weak, thus the supporting role of which in the steel market price was gradually weakening.

Table 2 shows that the bearing steel price in East China dropped in Jun and the overall trend was "first rise and then fall", showing a certain increase compared with the beginning of the month.

III. Domestic Bearing Steel Market will Experience Vulnerable Consolidation:

1. Raw materials

The high-chrome prices dropped in Jun, and the quoted price at the end of the month was around 7750 yuan/ton, 150 yuan/ton fell compared with last month, and returning to the low level in April and May. Though the market performance of iron ore and the like raw materials was a bit better than that of the steel market, the tendency was relatively weak, thus the supporting role of which in the steel market price was gradually weakening.

Figure 4: Average Price Trend of Domestic High Carbon Ferrochrome from 2011 to 2012

Data Resource: Mysteel

2. Steel Mills

Through the average daily crude steel production was still at a high level in May, the output in Q3 is expected to remain at a high level lower than that in May due to the increase in the times of factory maintenance. According the related data, the electricity consumption in the whole society was 406.1 billion kwh, 5.2 % increased year on year, and showing a slight rebound compared with 3.7 % in April. However, this was still a lower level, which reflected the existence of the economic downward pressure. The electricity consumption in Shanghai, Hubei, Jiangxi showed negative growth in May. As the electricity consumption in the secondary industry accounts for 73% of the total electricity consumption and it was increased by only 3.8 % in May, with the range of increase 7.9 percentage points falling back, the electricity consumption growth rate in the whole society was brought down by about 6 percentage points. Due to the long-term decline in this phase, many downstream enterprises and traders became more cautious about placing orders, so much pressure was then put on the side of steel mills, and forced them to make some policy changes, among which, making adjustments in ex-factory prices worked as the most direct method. It can be said that with the deterioration of the economic environment, the pressure of steel mills is also growing.

3. Steel Market

The steel market in Jun was better from the macro level, and the domestic policies were relatively loose. The stimulating effect of the projects approved in early May will take only after all investments are put into place in succession. In June, the Central Bank announced the market operations, and promised to continue to invest 36 billion yuan. The market interest rate is obviously to stabilize, and the preliminary adjustment and fine adjustment are expected to be the main methods in short term. The external structural tax cuts and increase in the approvement of value-added tax system reform pilots may be uniformly carried out in the third quarter. We can feel that the market downtrend is different from that in previous years: the economic is slowing down, the demand is shrinking, the turnover was in the doldrums, and the market is difficult to get warm through its own adjustments. Steel mills do not cut production, the European debt problem failed to have substantive solution, and no incremental demand is seen in the international market, all of which makes the market rebound lacking strength.

4. Market Outlook

The domestic credit needremained at the low level: business orders will become less, the credit needs in small and medium-sized enterprise will shrink due to the slowdown in exports; strict control will be put to large projects under construction or to be continued such as local financing platform; the loan-to-deposit ratio of most commercial bank is to remain at a high level; the deposit reserve ratio is to remain at a high level despite slight reduction have been made. The increase in the downstream demand for machinery, automobiles, shipbuilding will continue to rely on the pulling of major investment projects such as infrastructure, railways, highways, etc. The effect of national policies to the steel market will be much better than that in the second quarter, and the overall market will hit its bottom in July. It will take some time for the market to digest the price adjustment, and ease the supply pressure caused by the high output. It is said that the first half of the bear market is not over yet, and it will take about two years to release the real market demand.

To sum up, the bearing steel market is still possibly to go down, through the market is slowly moving towards a good direction. The bearing steel market is to hit in its bottom in July with downside potential.

Figure 4: Average Price Trend of Domestic High Carbon Ferrochrome from 2011 to 2012

Data Resource: Mysteel

2. Steel Mills

Through the average daily crude steel production was still at a high level in May, the output in Q3 is expected to remain at a high level lower than that in May due to the increase in the times of factory maintenance. According the related data, the electricity consumption in the whole society was 406.1 billion kwh, 5.2 % increased year on year, and showing a slight rebound compared with 3.7 % in April. However, this was still a lower level, which reflected the existence of the economic downward pressure. The electricity consumption in Shanghai, Hubei, Jiangxi showed negative growth in May. As the electricity consumption in the secondary industry accounts for 73% of the total electricity consumption and it was increased by only 3.8 % in May, with the range of increase 7.9 percentage points falling back, the electricity consumption growth rate in the whole society was brought down by about 6 percentage points. Due to the long-term decline in this phase, many downstream enterprises and traders became more cautious about placing orders, so much pressure was then put on the side of steel mills, and forced them to make some policy changes, among which, making adjustments in ex-factory prices worked as the most direct method. It can be said that with the deterioration of the economic environment, the pressure of steel mills is also growing.

3. Steel Market

The steel market in Jun was better from the macro level, and the domestic policies were relatively loose. The stimulating effect of the projects approved in early May will take only after all investments are put into place in succession. In June, the Central Bank announced the market operations, and promised to continue to invest 36 billion yuan. The market interest rate is obviously to stabilize, and the preliminary adjustment and fine adjustment are expected to be the main methods in short term. The external structural tax cuts and increase in the approvement of value-added tax system reform pilots may be uniformly carried out in the third quarter. We can feel that the market downtrend is different from that in previous years: the economic is slowing down, the demand is shrinking, the turnover was in the doldrums, and the market is difficult to get warm through its own adjustments. Steel mills do not cut production, the European debt problem failed to have substantive solution, and no incremental demand is seen in the international market, all of which makes the market rebound lacking strength.

4. Market Outlook

The domestic credit needremained at the low level: business orders will become less, the credit needs in small and medium-sized enterprise will shrink due to the slowdown in exports; strict control will be put to large projects under construction or to be continued such as local financing platform; the loan-to-deposit ratio of most commercial bank is to remain at a high level; the deposit reserve ratio is to remain at a high level despite slight reduction have been made. The increase in the downstream demand for machinery, automobiles, shipbuilding will continue to rely on the pulling of major investment projects such as infrastructure, railways, highways, etc. The effect of national policies to the steel market will be much better than that in the second quarter, and the overall market will hit its bottom in July. It will take some time for the market to digest the price adjustment, and ease the supply pressure caused by the high output. It is said that the first half of the bear market is not over yet, and it will take about two years to release the real market demand.

To sum up, the bearing steel market is still possibly to go down, through the market is slowly moving towards a good direction. The bearing steel market is to hit in its bottom in July with downside potential.

1.The news above mentioned with detailed source are from internet.We are trying our best to assure they are accurate ,timely and safe so as to let bearing users and sellers read more related info.However, it doesn't mean we agree with any point of view referred in above contents and we are not responsible for the authenticity. If you want to publish the news,please note the source and you will be legally responsible for the news published.

2.All news edited and translated by us are specially noted the source"CBCC".

3.For investors,please be cautious for all news.We don't bear any damage brought by late and inaccurate news.

4.If the news we published involves copyright of yours,just let us know.

Next Aug 17 Bearing Steel Price in Different Regions of China

BRIEF INTRODUCTION

Cnbearing is the No.1 bearing inquiry system and information service in China, dedicated to helping all bearing users and sellers throughout the world.

Cnbearing is supported by China National Bearing Industry Association, whose operation online is charged by China Bearing Unisun Tech. Co., Ltd.

China Bearing Unisun Tech. Co., Ltd owns all the rights. Since 2000, over 3,000 companies have been registered and enjoyed the company' s complete skillful service, which ranking many aspects in bearing industry at home and abroad with the most authority practical devices in China.