The bearing steel market is to remain the vulnerable consolidation state in December

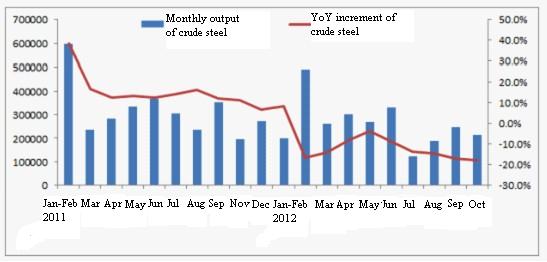

Figure 1: Change in Domestic Output of Bearing Steel (crude steel) from 2011 to 2012

Data Resource: Special Steel Association

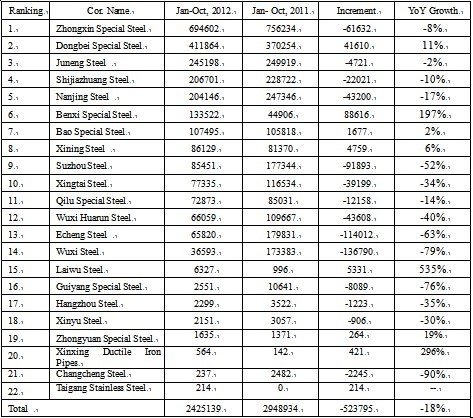

Table 1: Domestic Output of Crude Steel by Bearing Steel Manufacturers from January to October in 2012 (Unit: ton)

Figure 1: Change in Domestic Output of Bearing Steel (crude steel) from 2011 to 2012

Data Resource: Special Steel Association

Table 1: Domestic Output of Crude Steel by Bearing Steel Manufacturers from January to October in 2012 (Unit: ton)

Seen from Table 1 that the top three for bearing steel output from January to October in 2012 are Zhongxin Special Steel (Xinye Steel and Xingcheng Special Steel), Dongbei Speical Steel and Juneng Steel, and the rankings of other steel mills bore only small change (for Sha Steel, only the yield of Huai Steel is counted; some modifications are made to the statistical method for calculating Baosteel's output).

II. Performance of Domestic Bearing Steel Market in November:

(i) The export volume of bearing steel from January to October in 2012 continued to fall

According to the statistical data released by the ten major domestic bearing steel manufacturers, the export volume of bearing steel in October decreased by 41.0%, and the total export volume from January to October was 72,062 tons.

Figure 2: Bearing Steel Export Situation in Major Domestic Special Steel Enterprises from 2011 to 2012

Seen from Table 1 that the top three for bearing steel output from January to October in 2012 are Zhongxin Special Steel (Xinye Steel and Xingcheng Special Steel), Dongbei Speical Steel and Juneng Steel, and the rankings of other steel mills bore only small change (for Sha Steel, only the yield of Huai Steel is counted; some modifications are made to the statistical method for calculating Baosteel's output).

II. Performance of Domestic Bearing Steel Market in November:

(i) The export volume of bearing steel from January to October in 2012 continued to fall

According to the statistical data released by the ten major domestic bearing steel manufacturers, the export volume of bearing steel in October decreased by 41.0%, and the total export volume from January to October was 72,062 tons.

Figure 2: Bearing Steel Export Situation in Major Domestic Special Steel Enterprises from 2011 to 2012

Data Resource: MRI

The prices in bearing steel market experienced a narrow range of consolidation in November

The prices in bearing steel market slightly increased in November. The southern steel mills made greater adjustments in ex-factory price, which led to big rise in the East China market. While northern steel mills were cautious to price adjustment and made small only small adjustment, thus resulting in relatively small rise in the market. The detailed situations of bearing steel market across the country in October are as follows:

The bearing steel price in Hangzhou market slightly increased, and the market transactions became better. Up to the end of November, the average knock-down price of standard GCr15 continuous casting non-annealed steel was from 4,250 to 4,500 yuan/ton, and the average knock-down price of GCr15 die-casting annealed steel was between 7,500 and 7,700 yuan/ton.

The bearing steel price in Luoyang market was relatively stable and the deal was commom. Up to the end of November, the average knock-down price of standard GCr15 continuous casting non-annealed steel was from 4,350 to 4,550 yuan/ton, and the average knock-down price of GCr15 die-casting annealed steel was from 7500 to 7,600 yuan/ton.

The bearing steel price in Xi'an market was stable and the deal was light. Up to the end of November, the spot goods of standard GCr15 continuous casting non-annealed steel was relatively insufficient, and the average knock-down price of GCr15 die-casting annealed steel was around 7,500 yuan/ton.

As for Chongqing and Chengdu markets, the prices remained stable, and the deal was common. Up to the end of November, the average knock-down price of standard GCr15 continuous casting non-annealed steel was from 5050 to 5100 yuan/ton, and the average knock-down price of GCr15 die-casting annealed steel was around 7,450 yuan/ton.

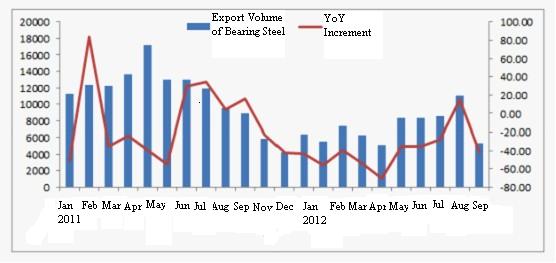

Figure 3: Average Price Trend of Domestic Bearing Steel from 2011 to 2012

Data Resource: MRI

The prices in bearing steel market experienced a narrow range of consolidation in November

The prices in bearing steel market slightly increased in November. The southern steel mills made greater adjustments in ex-factory price, which led to big rise in the East China market. While northern steel mills were cautious to price adjustment and made small only small adjustment, thus resulting in relatively small rise in the market. The detailed situations of bearing steel market across the country in October are as follows:

The bearing steel price in Hangzhou market slightly increased, and the market transactions became better. Up to the end of November, the average knock-down price of standard GCr15 continuous casting non-annealed steel was from 4,250 to 4,500 yuan/ton, and the average knock-down price of GCr15 die-casting annealed steel was between 7,500 and 7,700 yuan/ton.

The bearing steel price in Luoyang market was relatively stable and the deal was commom. Up to the end of November, the average knock-down price of standard GCr15 continuous casting non-annealed steel was from 4,350 to 4,550 yuan/ton, and the average knock-down price of GCr15 die-casting annealed steel was from 7500 to 7,600 yuan/ton.

The bearing steel price in Xi'an market was stable and the deal was light. Up to the end of November, the spot goods of standard GCr15 continuous casting non-annealed steel was relatively insufficient, and the average knock-down price of GCr15 die-casting annealed steel was around 7,500 yuan/ton.

As for Chongqing and Chengdu markets, the prices remained stable, and the deal was common. Up to the end of November, the average knock-down price of standard GCr15 continuous casting non-annealed steel was from 5050 to 5100 yuan/ton, and the average knock-down price of GCr15 die-casting annealed steel was around 7,450 yuan/ton.

Figure 3: Average Price Trend of Domestic Bearing Steel from 2011 to 2012

Data Resource: Mysteel

According to the statistics from Mysteeel.com: up to the end of November, 2012, the average price of GCr15 Φ50mm continuous casting non-annealed steel in China was 4,810 yuan/ton; the average price of GCr15 Φ100mm die-casting annealed steel was 7,800 yuan/ton. (some modifications applied to the statistical method)

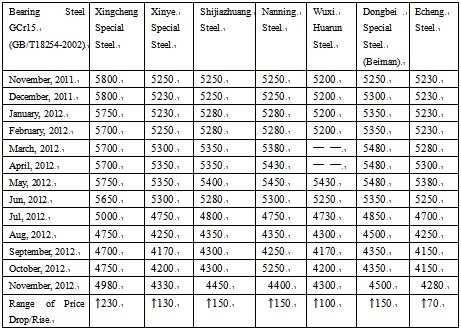

Table 2: Summary of Sales Price of Major Bearing Steel Manufacturers in East China (standard continuous casting non-annealed steel bar) Unit: yuan

Data Resource: Mysteel

According to the statistics from Mysteeel.com: up to the end of November, 2012, the average price of GCr15 Φ50mm continuous casting non-annealed steel in China was 4,810 yuan/ton; the average price of GCr15 Φ100mm die-casting annealed steel was 7,800 yuan/ton. (some modifications applied to the statistical method)

Table 2: Summary of Sales Price of Major Bearing Steel Manufacturers in East China (standard continuous casting non-annealed steel bar) Unit: yuan

Table 2 shows that the bearing steel prices in East China slightly rebounded in November, mainly in the range of 100-150 yuan/ton. Traders now have less stock, and the market transactions appeared no good. The uptrend was mainly driven by the increase in ex-factory price, and the balance between supply and demand provided the confidence to traders to raise the price. But most market participants still fell negative to the market outlook.

III. The Bearing Steel Market is to operate in Weak Vulnerable Consolidation:

1. Raw materials

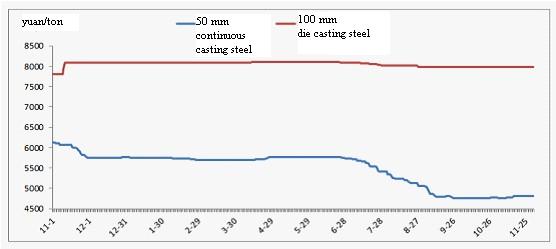

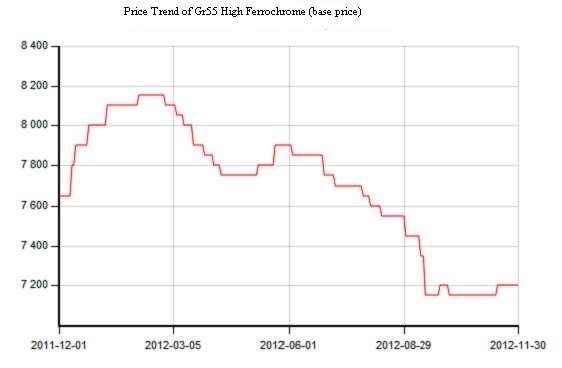

The high-chrome prices dropped in November, and the quoted price at the end of the month was around 7200 yuan/ton, 50 yuan/ton down compared with last month.

Table 2 shows that the bearing steel prices in East China slightly rebounded in November, mainly in the range of 100-150 yuan/ton. Traders now have less stock, and the market transactions appeared no good. The uptrend was mainly driven by the increase in ex-factory price, and the balance between supply and demand provided the confidence to traders to raise the price. But most market participants still fell negative to the market outlook.

III. The Bearing Steel Market is to operate in Weak Vulnerable Consolidation:

1. Raw materials

The high-chrome prices dropped in November, and the quoted price at the end of the month was around 7200 yuan/ton, 50 yuan/ton down compared with last month.

Figure 4: Average Price Trend of Domestic High Carbon Ferrochrome from 2011 to 2012

Data Resource: Mysteel

2. Steel Mills

Major large and medium-sized enterprises realized the average daily production of crude steel of 1.6328 million tons in mid-November, down 0.3% QoQ; the estimated average daily production of crude steel was 1,951,800 tons, down 0.25% QoQ. Many steel mills raised the ex-factory price, but there are large differences between the south and north: The southern steel mills made greater adjustments in ex-factory price while northern steel mills were cautious to price adjustment and not optimistic to the market outlook.

3. Steel Market

The bearing steel market showed steady performance in November, where the balance between supply and demand was basicly realized. The market performance can be regarded as good based on the overall situation this year, but traders' attitudes were obviously negative than steel mills, and the market was expected to fall in December. The depressing trend this year forced traders to give up the idea of stock up, and they mainly tried to keep less stock.

4. Downstream Market

The investment for 2013 national railway infrastructure was tentatively fixed at 530 billion yuan by the Ministry of Railways, railways and other infrastructure investment will continue to accelerate, and the steady growth measures will gradually show the effect; exports, investment, electricity consumption and other major indicators suggest that the economy continues to improve; water conservancy and other projects are under accelerated operation, and steel prices is relatively low with less probability of sharp decline. However, the real estate investment and new construction area continue to fall, and with frequent snowfall over the north, the winter has come, so overall demand will somewhat decline.

5. Market Outlook

Based on the current trend, it seems the bullish factors are not stable enough, and by the end of this month, the market mentality in some ares has become better, which, however, fails to directly reflected on to the quoted prices. As expected in December, the bearing steel market is to operate in shock consolidation, with the possibility of slight fall in second half of the month.

Figure 4: Average Price Trend of Domestic High Carbon Ferrochrome from 2011 to 2012

Data Resource: Mysteel

2. Steel Mills

Major large and medium-sized enterprises realized the average daily production of crude steel of 1.6328 million tons in mid-November, down 0.3% QoQ; the estimated average daily production of crude steel was 1,951,800 tons, down 0.25% QoQ. Many steel mills raised the ex-factory price, but there are large differences between the south and north: The southern steel mills made greater adjustments in ex-factory price while northern steel mills were cautious to price adjustment and not optimistic to the market outlook.

3. Steel Market

The bearing steel market showed steady performance in November, where the balance between supply and demand was basicly realized. The market performance can be regarded as good based on the overall situation this year, but traders' attitudes were obviously negative than steel mills, and the market was expected to fall in December. The depressing trend this year forced traders to give up the idea of stock up, and they mainly tried to keep less stock.

4. Downstream Market

The investment for 2013 national railway infrastructure was tentatively fixed at 530 billion yuan by the Ministry of Railways, railways and other infrastructure investment will continue to accelerate, and the steady growth measures will gradually show the effect; exports, investment, electricity consumption and other major indicators suggest that the economy continues to improve; water conservancy and other projects are under accelerated operation, and steel prices is relatively low with less probability of sharp decline. However, the real estate investment and new construction area continue to fall, and with frequent snowfall over the north, the winter has come, so overall demand will somewhat decline.

5. Market Outlook

Based on the current trend, it seems the bullish factors are not stable enough, and by the end of this month, the market mentality in some ares has become better, which, however, fails to directly reflected on to the quoted prices. As expected in December, the bearing steel market is to operate in shock consolidation, with the possibility of slight fall in second half of the month.

1.The news above mentioned with detailed source are from internet.We are trying our best to assure they are accurate ,timely and safe so as to let bearing users and sellers read more related info.However, it doesn't mean we agree with any point of view referred in above contents and we are not responsible for the authenticity. If you want to publish the news,please note the source and you will be legally responsible for the news published.

2.All news edited and translated by us are specially noted the source"CBCC".

3.For investors,please be cautious for all news.We don't bear any damage brought by late and inaccurate news.

4.If the news we published involves copyright of yours,just let us know.

Next Aug 17 Bearing Steel Price in Different Regions of China

BRIEF INTRODUCTION

Cnbearing is the No.1 bearing inquiry system and information service in China, dedicated to helping all bearing users and sellers throughout the world.

Cnbearing is supported by China National Bearing Industry Association, whose operation online is charged by China Bearing Unisun Tech. Co., Ltd.

China Bearing Unisun Tech. Co., Ltd owns all the rights. Since 2000, over 3,000 companies have been registered and enjoyed the company' s complete skillful service, which ranking many aspects in bearing industry at home and abroad with the most authority practical devices in China.