Bearing steel market will show the trend of weak consolidation in December

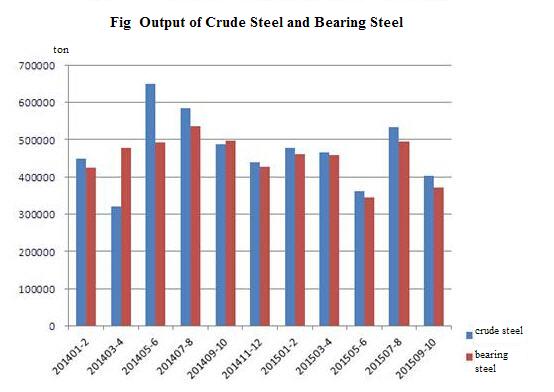

(ii) The majority of steel mills reported YoY decrease in the output of bearing steel

(ii) The majority of steel mills reported YoY decrease in the output of bearing steel

Seen from Table 1 that the top three for bearing steel output from January to October 2015 are still Zhongxin Special Steel (Xinye Steel and Xingcheng Special Steel), Dongbei Speical Steel and Juneng Steel. (for Sha Steel, only the yield of Huai Steel is counted). Among these 23 companies, only one reported increase in the crude bearing steel ouput, while 20 companies fell, 2 out of production.

2. Export: export fell slightly YoY in October

Domestic bearing steel export was 129,860 tons in October, increased by 40.77% YoY and 24.88% MoM. Total export volume in the first ten months was 105,085 tons, representing a reduction of 9.26% over the same period last year. In October, Xingcheng Special Steel reported the largest export volume of bearing steel, 11,311 tons, accounting for the vast majority of bearing steel exports.

Seen from Table 1 that the top three for bearing steel output from January to October 2015 are still Zhongxin Special Steel (Xinye Steel and Xingcheng Special Steel), Dongbei Speical Steel and Juneng Steel. (for Sha Steel, only the yield of Huai Steel is counted). Among these 23 companies, only one reported increase in the crude bearing steel ouput, while 20 companies fell, 2 out of production.

2. Export: export fell slightly YoY in October

Domestic bearing steel export was 129,860 tons in October, increased by 40.77% YoY and 24.88% MoM. Total export volume in the first ten months was 105,085 tons, representing a reduction of 9.26% over the same period last year. In October, Xingcheng Special Steel reported the largest export volume of bearing steel, 11,311 tons, accounting for the vast majority of bearing steel exports.

3. Mainstream price policy in October: The majority of steel mills remained weak on a stable basis

Ex-factory Price of Bearing Steel

3. Mainstream price policy in October: The majority of steel mills remained weak on a stable basis

Ex-factory Price of Bearing Steel

In November, domestic bearing steel market remained at the bottom. The prices of mainstream resources will decline in the range of 50-80 yuan/ton, in line with the previous forecast. Affected by the poor downstream demand, businesses financial constraints and other reasons, the domestic bearing steel prices is predicted to remain on at the bottom in December.

II. Relevant Markets

1. Raw materials market

(i) Iron ore

In November, domestic bearing steel market remained at the bottom. The prices of mainstream resources will decline in the range of 50-80 yuan/ton, in line with the previous forecast. Affected by the poor downstream demand, businesses financial constraints and other reasons, the domestic bearing steel prices is predicted to remain on at the bottom in December.

II. Relevant Markets

1. Raw materials market

(i) Iron ore

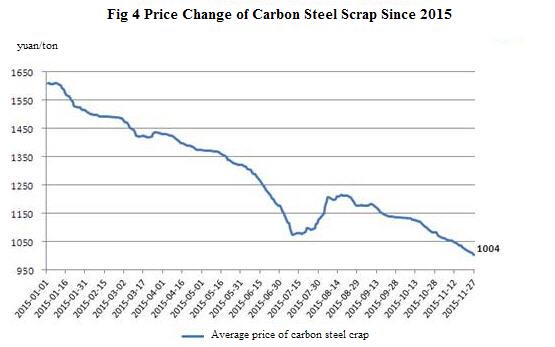

(ii) Steel scrap

(ii) Steel scrap

(iii) High carbon ferro-chrome

(iii) High carbon ferro-chrome

Imported ore prices fell down significantly in October, closed at 44 dollar per dry metric ton at the end of the month; Carbon steel scrap market remained depressed, closed at 1004 yuan/ton by the end of the month, down by 7.21% over the previous month; high carbon ferrochrome prices kept falling, closed at 5900 yuan/ton by the end of the month. During the off-season, northern mills will gradually shut down for maintenance, while the Southern market is affected by the flow of northern steel products. Traders are mainly lack of confidence in the market outlook. The supply and demand pressure remains, and raw material prices will not improve in short term. The raw materials market is expected to stay in weak trend in December.

2. Downstream markets

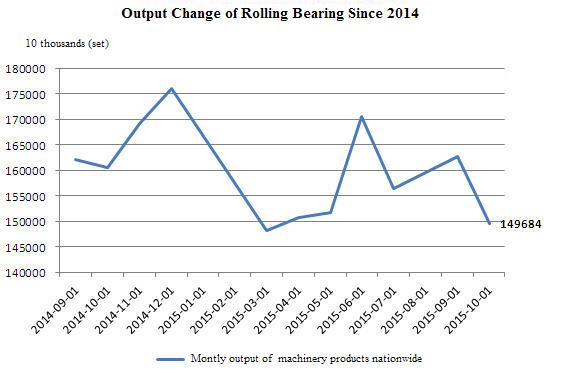

(i) Rolling Bearings

According to the data from China Machinery Industry Association, the output of rolling bearings in October was 1.49684 billion sets, 1.62704 billion in September, decreased by 8.01% over the same period last month.

Imported ore prices fell down significantly in October, closed at 44 dollar per dry metric ton at the end of the month; Carbon steel scrap market remained depressed, closed at 1004 yuan/ton by the end of the month, down by 7.21% over the previous month; high carbon ferrochrome prices kept falling, closed at 5900 yuan/ton by the end of the month. During the off-season, northern mills will gradually shut down for maintenance, while the Southern market is affected by the flow of northern steel products. Traders are mainly lack of confidence in the market outlook. The supply and demand pressure remains, and raw material prices will not improve in short term. The raw materials market is expected to stay in weak trend in December.

2. Downstream markets

(i) Rolling Bearings

According to the data from China Machinery Industry Association, the output of rolling bearings in October was 1.49684 billion sets, 1.62704 billion in September, decreased by 8.01% over the same period last month.

(ii) Motorcycles

According to the statistical analysis of China Association of Automobile Manufacturers, the output and sales of motorcycles fell sharply in October, only better than in February. Wherein, the monthly sales hit the second lowest level this year. The total sales in this sector fell further from January to October. In October, the production and sales of motorcycles was respectively 1,429,200 and 1,452,300, down by 10.74% and 9.41% MoM, and 20.38% and 18.96% YoY. Wherein, the decline was widened to 7.38 and 5.04 percentage points respectively than in September. From January to October, the industry sales totaled 15,684,200 and 15,722,000, down by 9.98% and 10.01%. Wherein, the decline was 1.2 and 1.03 percentage points expanded than in the first nine months.

(iii) Automobiles

According to the statistical analysis of China Association of Automobile Manufacturers, the production and sales of automobiles showed rapid growth in September 2015, and the year-on-year decline range narrowed, with continuous increase in sales. From January to October, the production and sales both increased compared with last year. In October, the automobile production was 2,188,700, increased by 15.54% MoM, and 7.06% YoY; the automobile sales was 2,221,600 sets, increased by 9.72% MoM and 11.79% YoY. From January to October, the output and sales of automobiles was 19,278,100 and 19,278,100 sets, respectively increased by 0.02% and 1.51% YoY.

III. Conclusions

In November, the domestic bearing steel market remained under pressure, poorly traded. According to the survey, the majority of bearing steel mills are now at loss, more or less, which has greatly dampened their enthusiasm in production. Some have adjusted the product structure and reduce the production of bearing steel, especially for the "High-quality Steel upgraded from Common Steel" manufacturers. With the end of the year approaching, money gets tight. Coupled with poor demand in the downstream maket, steel mills receive less orders.

It is expected to see no strong inversion in bearing steel market, and downstream demand remained low, so the overall supply and demand pressure will not be released greatly. Fortunately, traders only have small inventory, which means that the downslide potential is not high, but the power to promote rise is even weak.

In conclusion, the bearing steel market is predicted to remain in weak consolidation in December.

(ii) Motorcycles

According to the statistical analysis of China Association of Automobile Manufacturers, the output and sales of motorcycles fell sharply in October, only better than in February. Wherein, the monthly sales hit the second lowest level this year. The total sales in this sector fell further from January to October. In October, the production and sales of motorcycles was respectively 1,429,200 and 1,452,300, down by 10.74% and 9.41% MoM, and 20.38% and 18.96% YoY. Wherein, the decline was widened to 7.38 and 5.04 percentage points respectively than in September. From January to October, the industry sales totaled 15,684,200 and 15,722,000, down by 9.98% and 10.01%. Wherein, the decline was 1.2 and 1.03 percentage points expanded than in the first nine months.

(iii) Automobiles

According to the statistical analysis of China Association of Automobile Manufacturers, the production and sales of automobiles showed rapid growth in September 2015, and the year-on-year decline range narrowed, with continuous increase in sales. From January to October, the production and sales both increased compared with last year. In October, the automobile production was 2,188,700, increased by 15.54% MoM, and 7.06% YoY; the automobile sales was 2,221,600 sets, increased by 9.72% MoM and 11.79% YoY. From January to October, the output and sales of automobiles was 19,278,100 and 19,278,100 sets, respectively increased by 0.02% and 1.51% YoY.

III. Conclusions

In November, the domestic bearing steel market remained under pressure, poorly traded. According to the survey, the majority of bearing steel mills are now at loss, more or less, which has greatly dampened their enthusiasm in production. Some have adjusted the product structure and reduce the production of bearing steel, especially for the "High-quality Steel upgraded from Common Steel" manufacturers. With the end of the year approaching, money gets tight. Coupled with poor demand in the downstream maket, steel mills receive less orders.

It is expected to see no strong inversion in bearing steel market, and downstream demand remained low, so the overall supply and demand pressure will not be released greatly. Fortunately, traders only have small inventory, which means that the downslide potential is not high, but the power to promote rise is even weak.

In conclusion, the bearing steel market is predicted to remain in weak consolidation in December.

1.The news above mentioned with detailed source are from internet.We are trying our best to assure they are accurate ,timely and safe so as to let bearing users and sellers read more related info.However, it doesn't mean we agree with any point of view referred in above contents and we are not responsible for the authenticity. If you want to publish the news,please note the source and you will be legally responsible for the news published.

2.All news edited and translated by us are specially noted the source"CBCC".

3.For investors,please be cautious for all news.We don't bear any damage brought by late and inaccurate news.

4.If the news we published involves copyright of yours,just let us know.

Next Aug 17 Bearing Steel Price in Different Regions of China

BRIEF INTRODUCTION

Cnbearing is the No.1 bearing inquiry system and information service in China, dedicated to helping all bearing users and sellers throughout the world.

Cnbearing is supported by China National Bearing Industry Association, whose operation online is charged by China Bearing Unisun Tech. Co., Ltd.

China Bearing Unisun Tech. Co., Ltd owns all the rights. Since 2000, over 3,000 companies have been registered and enjoyed the company' s complete skillful service, which ranking many aspects in bearing industry at home and abroad with the most authority practical devices in China.