RBC Bearings Incorporated (ROLL) Analysts See $0.86 EPS

Investors sentiment increased to 2 in Q3 2017. Its up 0.28, from 1.72 in 2017Q2. It increased, as 13 investors sold RBC Bearings Incorporated shares while 34 reduced holdings. 30 funds opened positions while 64 raised stakes. 23.19 million shares or 2.43% less from 23.77 million shares in 2017Q2 were reported.

Bank & Trust Of America De reported 0% in RBC Bearings Incorporated (NASDAQ:ROLL). Davis R M holds 41,930 shares or 0.22% of its portfolio. Moreover, Prudential Fincl has 0% invested in RBC Bearings Incorporated (NASDAQ:ROLL) for 3,514 shares. Retail Bank Of Montreal Can accumulated 479 shares or 0% of the stock.

Wesbanco Bank & Trust Incorporated accumulated 1,980 shares. Susquehanna Int Group Llp reported 0% stake. Parametrica Mgmt holds 0.1% of its portfolio in RBC Bearings Incorporated (NASDAQ:ROLL) for 1,900 shares. Moreover, Voya Investment Mgmt Ltd Liability Com has 0% invested in RBC Bearings Incorporated (NASDAQ:ROLL). Bnp Paribas Arbitrage Sa invested in 0% or 2,802 shares. Us National Bank De has invested 0.01% in RBC Bearings Incorporated (NASDAQ:ROLL). Peak6 L P has invested 0% of its portfolio in RBC Bearings Incorporated (NASDAQ:ROLL). Eagle Asset Mngmt Inc owns 0.03% invested in RBC Bearings Incorporated (NASDAQ:ROLL) for 47,799 shares. Aperio Group Llc holds 0% of its portfolio in RBC Bearings Incorporated (NASDAQ:ROLL) for 3,787 shares. Moreover, Aqr Cap Mgmt Ltd Llc has 0% invested in RBC Bearings Incorporated (NASDAQ:ROLL) for 4,467 shares. Wells Fargo & Mn reported 629,102 shares.

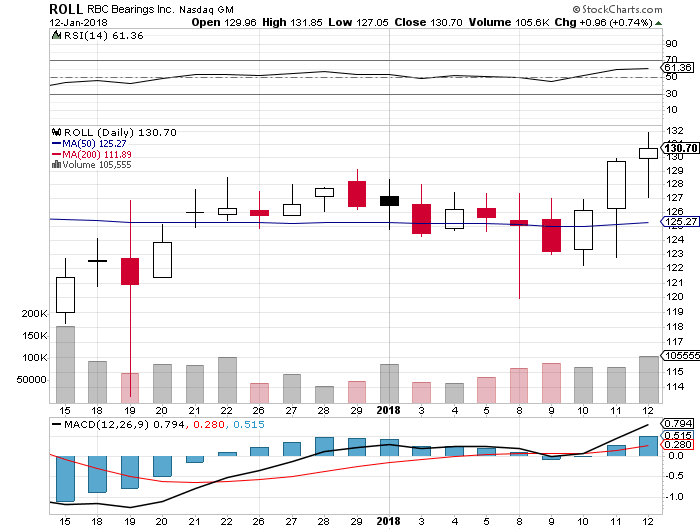

Analysts expect RBC Bearings Incorporated (NASDAQ:ROLL) to report $0.86 EPS on February, 14.They anticipate $0.13 EPS change or 17.81 % from last quarter’s $0.73 EPS. ROLL’s profit would be $20.31 million giving it 37.10 P/E if the $0.86 EPS is correct. After having $0.83 EPS previously, RBC Bearings Incorporated’s analysts see 3.61 % EPS growth. The stock decreased 0.58% or $0.74 during the last trading session, reaching $127.64. About 12,515 shares traded. RBC Bearings Incorporated (NASDAQ:ROLL) has risen 38.75% since January 23, 2017 and is uptrending. It has outperformed by 22.05% the S&P500.

RBC Bearings Incorporated (NASDAQ:ROLL) Ratings Coverage

Among 9 analysts covering RBC Bearings (NASDAQ:ROLL), 6 have Buy rating, 0 Sell and 3 Hold. Therefore 67% are positive. RBC Bearings had 11 analyst reports since September 22, 2015 according to SRatingsIntel. On Wednesday, November 29 the stock rating was initiated by C.L. King with “Buy”. The firm has “Hold” rating given on Tuesday, September 22 by TheStreet. KeyBanc Capital Markets maintained the stock with “Hold” rating in Friday, September 15 report. The company was downgraded on Friday, November 6 by Seaport Global Securities. The stock of RBC Bearings Incorporated (NASDAQ:ROLL) has “Neutral” rating given on Friday, October 14 by Seaport Global Securities. Avondale maintained the shares of ROLL in report on Monday, March 21 with “Market Outperform” rating. On Monday, September 28 the stock rating was upgraded by Global Hunter Securities to “Buy”. The stock of RBC Bearings Incorporated (NASDAQ:ROLL) earned “Sector Weight” rating by KeyBanc Capital Markets on Tuesday, August 9. The firm earned “Buy” rating on Wednesday, November 8 by Bank of America.

RBC Bearings Incorporated manufactures and markets engineered precision bearings and components in North America, Europe, Asia, and Latin America. The company has market cap of $3.02 billion. It operates in four divisions: Plain Bearings, Roller Bearings, Ball Bearings, and Engineered Products. It has a 43.25 P/E ratio. The Plain Bearings segment produces plain bearings with self-lubricating or metal-to-metal designs, including rod end bearings, spherical plain bearings, and journal bearings that are primarily used to rectify misalignments in various mechanical components, such as aircraft controls, helicopter rotors, or in heavy mining and construction equipment.

1.The news above mentioned with detailed source are from internet.We are trying our best to assure they are accurate ,timely and safe so as to let bearing users and sellers read more related info.However, it doesn't mean we agree with any point of view referred in above contents and we are not responsible for the authenticity. If you want to publish the news,please note the source and you will be legally responsible for the news published.

2.All news edited and translated by us are specially noted the source"CBCC".

3.For investors,please be cautious for all news.We don't bear any damage brought by late and inaccurate news.

4.If the news we published involves copyright of yours,just let us know.

Next 24 minutes 46.34 seconds-the longest spin duration for a one finger spinner

BRIEF INTRODUCTION

Cnbearing is the No.1 bearing inquiry system and information service in China, dedicated to helping all bearing users and sellers throughout the world.

Cnbearing is supported by China National Bearing Industry Association, whose operation online is charged by China Bearing Unisun Tech. Co., Ltd.

China Bearing Unisun Tech. Co., Ltd owns all the rights. Since 2000, over 3,000 companies have been registered and enjoyed the company' s complete skillful service, which ranking many aspects in bearing industry at home and abroad with the most authority practical devices in China.