Monthly data: The bearing steel market will continue to rise in May

Monthly data: The bearing steel market will continue to rise in May

Overview: From January to March, the output of domestic crude steel bearing steel increased by 23.97% year-on-year, and the output of bearing steel increased 17.08% year-on-year. Looking back at the bearing steel market in April, the price of the domestic bearing steel market continued to rise, driven by the rising cost of steel mills and the strengthening of the futures market in the second half of the year. Up to now, the average price of domestic bearing round steel 50mm (continuous casting) is 6255 yuan/ton, an increase of 155 yuan/ton from the end of March, an increase of 2.54% month-on-month. At present, downstream procurement costs have increased significantly compared with previous years. Excessive capital pressure has led to a slight slowdown in downstream procurement efforts, and the overall acceptance of high levels by terminal enterprises is low. With the announcement of the cancellation of export tax rebates for steel products, it is expected that the market price of bearing steel may continue to rise in May under the stimulus of the continuous increase in the price of premium steel.

1. Domestic production of bearing steel

(1) Bearing steel output from January to March 2021: Crude steel and steel both increased year-on-year

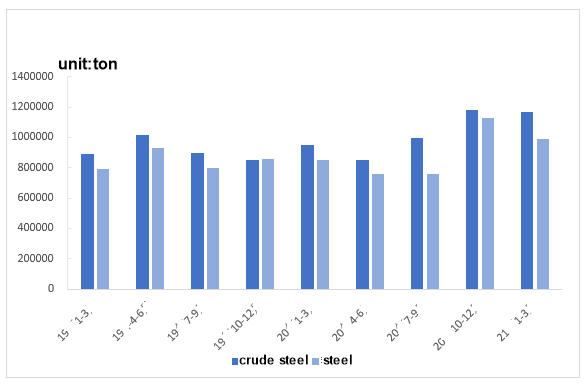

According to statistics from the Special Steel Association, from January to March 2021, my country’s major high-quality special steel enterprises produced 1.168 million tons of crude steel bearing steel, an increase of 23.97% compared with the same period last year; from January to March 2021, my country’s major high-quality special steels The company's bearing steel output was 988,800 tons, an increase of 17.08% compared with the same period last year, as shown in Figure 1.

(2) The output of finished products of bearing steel production enterprises from January to March 2021: the output of steel mills increased year-on-year

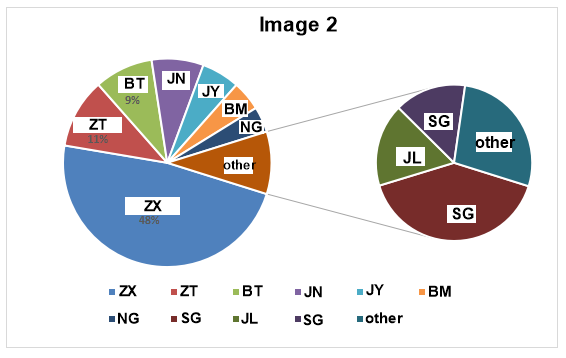

It can be seen from Figure 2 that the current output of bearing steel is relatively large: CITIC Special Steel (Xingcheng Special Steel, Daye Special Steel, Qingdao Iron and Steel), Zhongtian and Benxi Steel, accounting for 59% of the total output. The overall output of bearing steel increased from January to March 2021. The output of Beiman, Nangang, Shagang, Jiyuan, Juneng, and CITIC Special Steel all increased compared with the same period last year. Only Shigang, Xining and Benxi Steel Steel mills such as Xinggang and Xinggang have slightly reduced their output.

2. The performance of the domestic bearing steel market

In April, the domestic bearing steel market prices continued to strengthen, and the demand was acceptable. While steel mills are slightly profitable, the output of major bearing steel manufacturers is high, and the production schedule for May is still full, and there are few obvious reductions in production and maintenance. At present, the overall acceptance of high positions is low, and it takes time to digest high-priced resources, and there is a certain fear of heights in the market. However, given that raw material prices continue to rise, and some bearing steel manufacturers have received better orders, steel mills have a stronger intention to raise prices. It is expected that the bearing steel will oscillate and run strongly in May, and operation needs to be cautious.

3. Relevant market information

(1) Raw material price:

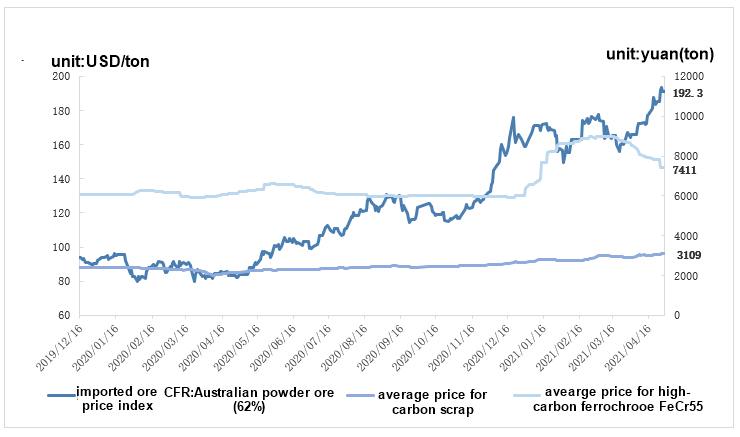

The iron ore market price fluctuated upward in April, and the Mysteel 62% Australian powder index was 192.3 US dollars/dry ton at the end of the month. With high steel mill profits and high downstream demand, the difference in demand between varieties continues to increase. The prices of some medium-to-high varieties are still firm, and short-term ore prices are unlikely to have a large callback opportunity. In addition, we need to continue to pay attention to the dynamics of environmental protection and production restrictions. Beware of environmental protection Limited production and fermentation; the general carbon steel scrap market has been consolidating and the demand is relatively strong. The average price at the end of the month is 3109 yuan/ton. Near the long holiday, most steel companies started to increase and buy goods before the holiday. The market mentality is mostly to hold the goods for the rise. Under the stimulus of the high profit of the finished product, the price of scrap steel will be strong in the short term; the market price of high-carbon ferrochromium continues to weaken. The price at the end of the month is 7411 yuan/ton. In the first half of the year, the market has sufficient supply of goods in circulation, superimposed on the increase in imported iron and the impact of price cuts, and the price of ferrochrome continues to fall under pressure. Due to environmental protection issues in the southern region, production has been affected, and the interests of downstream stainless steel plants have also been reduced. If both supply and demand are superimposed near the introduction of a new round of bidding prices, the market will stop falling and stabilize and wait for the price sentiment to be strong.

(2) Downstream industries

According to the statistics and analysis of the China Association of Automobile Manufacturers, in March 2021, automobile production and sales both increased rapidly month-on-month and year-on-year, reaching 2.462 million vehicles and 2.526 million vehicles, respectively, up 63.9% and 73.6% month-on-month and 71.6% and 74.9% year-on-year. From January to March, the production and sales of automobiles were 6.352 million and 6.484 million, a year-on-year increase of 81.7% and 75.6%.

4. Conclusion

In April, the bearing steel market price showed a trend of continuing to strengthen, and the demand from downstream terminal enterprises was acceptable. Although there was a phenomenon of replenishment at downstream terminals before the May Day holiday, due to the current market price rising too fast, terminal customer profits were severely compressed, and the overall acceptance of high levels was low. In the short term, on-demand procurement was the main focus. Taking into account the background of high prices, steel mills are bound to increase shipments, the speed of destocking may slow down, and prices may also be adjusted. It is expected that the bearing steel will oscillate and run strongly in the later period, and the operation still needs to be cautious.

1.The news above mentioned with detailed source are from internet.We are trying our best to assure they are accurate ,timely and safe so as to let bearing users and sellers read more related info.However, it doesn't mean we agree with any point of view referred in above contents and we are not responsible for the authenticity. If you want to publish the news,please note the source and you will be legally responsible for the news published.

2.All news edited and translated by us are specially noted the source"CBCC".

3.For investors,please be cautious for all news.We don't bear any damage brought by late and inaccurate news.

4.If the news we published involves copyright of yours,just let us know.

Next Baldor Enhances Same-Day Gearbox Assembly Operations

BRIEF INTRODUCTION

Cnbearing is the No.1 bearing inquiry system and information service in China, dedicated to helping all bearing users and sellers throughout the world.

Cnbearing is supported by China National Bearing Industry Association, whose operation online is charged by China Bearing Unisun Tech. Co., Ltd.

China Bearing Unisun Tech. Co., Ltd owns all the rights. Since 2000, over 3,000 companies have been registered and enjoyed the company' s complete skillful service, which ranking many aspects in bearing industry at home and abroad with the most authority practical devices in China.