Monthly data: The bearing steel market may rise slightly in September

Monthly data: The bearing steel market may rise slightly in September

Overview: From January to July, the output of domestic crude steel bearing steel increased by 35.80% year-on-year, and the output of bearing steel increased 28.43% year-on-year. Looking back at the bearing steel market in August, the downstream demand and capital flow support were insufficient, and the price of the bearing steel market showed a volatile and weak operating situation. Up to now, the average price of domestic bearing round steel 50mm (continuous casting) is 6,536 yuan/ton. With the high temperature season away, the demand for steel is expected to rebound from the previous month and the supply side will be reduced, and the market price of bearing steel is expected to rise slightly in September.

1. Domestic production of bearing steel

(1) The output of bearing steel from January to July 2021: both crude steel and steel increased year-on-year

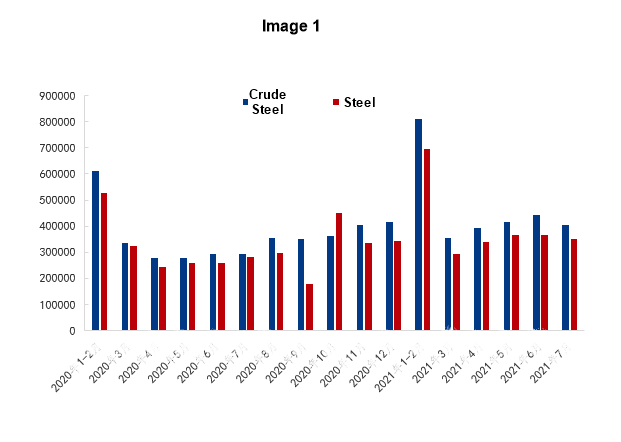

According to statistics from the Special Steel Association, from January to July 2021, my country’s main high-quality special steel enterprises produced 2,822,600 tons of crude steel bearing steel, an increase of 35.80% compared to the same period last year; from January to July 2021, my country’s main high-quality special steels The company’s bearing steel output was 2.4114 million tons, an increase of 28.43% compared to the same period last year, as shown in Figure 1.

Figure 1: Changes in crude steel and steel production of bearing steel across the country from 2020 to now

(2) The output of finished products of bearing steel production enterprises from January to July 2021: the output of steel mills increased year-on-year

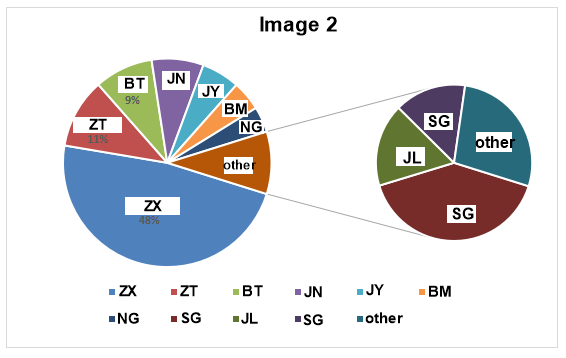

It can be seen from Figure 2 that the current production enterprises of bearing steel are: CITIC Special Steel (Xingcheng Special Steel, Daye Special Steel, Qingdao Iron and Steel), Zhongtian and Benxi Steel, accounting for 58% of the total output. . The overall output of bearing steel increased from January to July in 2021. The output of Beiman, Shagang, Xinggang, Nangang, Jiyuan, Xining, Zhongte, Juneeng, Laiwu Steel and other steel plants increased compared with the same period last year. The output of steel plants such as Jianlong, Shigang, Benxi Iron and Steel, Zhongtian decreased slightly.

Figure 2: The proportion of major enterprises' bearing steel output in total output from January to July 2021

2. The performance of the domestic bearing steel market

In August, the domestic bearing steel market price adjusted within a narrow range, the fundamentals performed poorly, and the profit level of the industry fell. In the off-season market in the recent stage, business confidence is obviously insufficient, and the demand for bearing steel has been suppressed from July to August. While the traditional seasonal constraints of the “Golden Nine and Silver Ten” decrease, demand may rebound slightly, but the current downstream demand is still lower than the level of the same period in 2019 and 2020, especially the manufacturing recession represented by the automobile industry. It is also reported that in August, Zhongtian, Metallurgical Steel, Benxi Iron and Steel, Juneng and other steel plants all have maintenance plans, and the supply pressure may be relieved in the later period. With the gradual arrival of the traditional peak consumption season, it is expected to be slightly destocked, and the market price of bearing steel is expected to rise slightly in September.

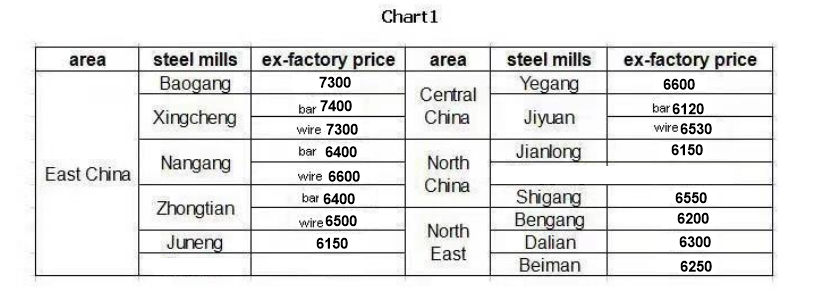

Table 1: Ex-factory acceptance prices of current bearing steel mills

3. Relevant market information

(1) Raw material price:

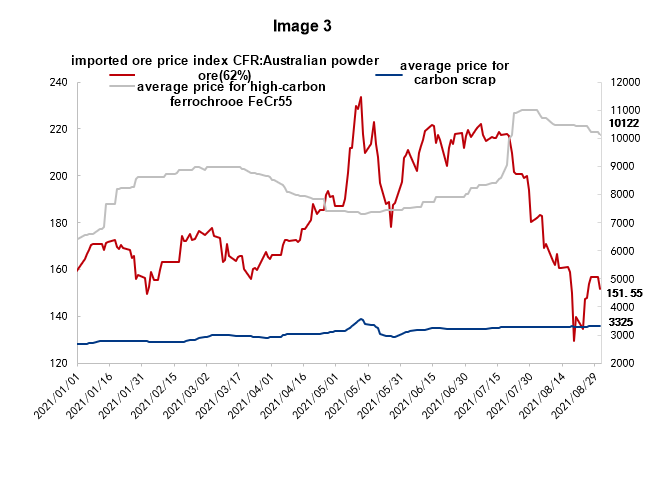

The price of iron ore continued to fall in August driven by fundamentals. At the end of the month, the Mysteel 62% Australian powder index was US$151.55/dry ton. With the further deepening of production restrictions, the gap between supply and demand of iron ore is expected to continue to expand in September, and the price of ore will be weak; domestic scrap prices are mainly stable and strong, with an average price of 3325 yuan/ton at the end of the month. Under the background of poor shipments in the off-season, the price rebound may be limited, and the price support for scrap steel may also be limited. It is expected that the short-term scrap market will be mainly adjusted in a narrow range; the high-carbon ferrochrome market is under pressure, and the contradiction between supply and demand continues to weaken , The price at the end of the month is 10,122 yuan/ton. Although the contradiction between supply and demand has eased, production has not yet fully recovered, and demand has not significantly weakened. The shortage of spot resources and tight inventory continue. It is expected that prices will be weak and stable in the later period.

Figure 3: Changes in the prices of some raw materials since 2021

(2) Downstream industries

According to the statistical analysis of the China Association of Automobile Manufacturers, in July 2021, the production and sales of automobiles were 1.863 million and 1.864 million, a year-on-year decrease of 15.5% and 11.9% respectively. From January to July, the production and sales of automobiles were 14.44 million and 14.756 million, an increase of 17.2% and 19.3% year-on-year. Affected by unfavorable factors such as the shortage of automotive chips and the full implementation of the National Sixth Emission Standard (commercial vehicles), my country's automobile production and sales have shown a year-on-year decline, but the sales of new energy vehicles have maintained rapid growth, with a market penetration rate of 10% in the first seven months.

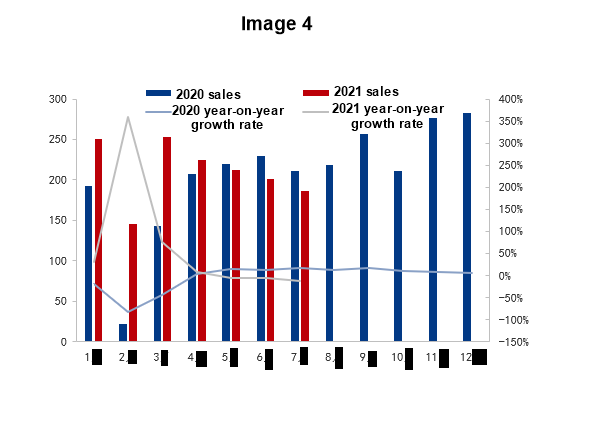

Figure 4: Monthly car sales and year-on-year changes since 2020.

5. Conclusion

Looking back at the bearing steel market in August, the market price showed a fluctuating and weak operation trend, and the overall performance did not improve very well compared with the previous period. However, in view of the slight narrowing of the price difference between the GCr15 price and the 45# carbon structure steel, the price difference between most steel plants is 400-650 yuan/ton, and the possibility of a later price reduction is small. Although the current market transaction situation is still unsatisfactory, September has been the peak season for steel market demand, and there is still a possibility of an improvement in transactions. There will be a slight decrease in the supply side in the later stage of the superposition. It is expected that the bearing steel market price in September may rise slightly.

1.The news above mentioned with detailed source are from internet.We are trying our best to assure they are accurate ,timely and safe so as to let bearing users and sellers read more related info.However, it doesn't mean we agree with any point of view referred in above contents and we are not responsible for the authenticity. If you want to publish the news,please note the source and you will be legally responsible for the news published.

2.All news edited and translated by us are specially noted the source"CBCC".

3.For investors,please be cautious for all news.We don't bear any damage brought by late and inaccurate news.

4.If the news we published involves copyright of yours,just let us know.

Next Baldor Enhances Same-Day Gearbox Assembly Operations

BRIEF INTRODUCTION

Cnbearing is the No.1 bearing inquiry system and information service in China, dedicated to helping all bearing users and sellers throughout the world.

Cnbearing is supported by China National Bearing Industry Association, whose operation online is charged by China Bearing Unisun Tech. Co., Ltd.

China Bearing Unisun Tech. Co., Ltd owns all the rights. Since 2000, over 3,000 companies have been registered and enjoyed the company' s complete skillful service, which ranking many aspects in bearing industry at home and abroad with the most authority practical devices in China.