Monthly data: The trend of the bearing steel market will up in April

Overview: From January to February 2022, domestic crude bearing steel output increased by 4.61% year-on-year, and bearing steel output increased by 9.55% year-on-year. Looking back at the bearing steel market in March, the prices of mid-to-high-end materials of GCr15 rose slightly, the prices of low-priced resources consolidated within a narrow range, and downstream demand was tepid. Up to now, the average price of domestic bearing round steel 50mm (continuous casting) is 6,592 yuan/ton, an increase of 37 yuan/ton from the end of February, and a month-on-month increase of 0.56%. At present, the epidemic situation in various places has a great impact on the terminal manufacturing industry, and the confidence of market merchants is obviously insufficient. However, in view of the rising raw material prices, the rising cost of steel mills, and the high cost of new arrivals in the later market, it is expected that the market price of bearing steel will continue to rise in April.

1. Domestic production of bearing steel

(1) Bearing steel output in January-February 2022: crude steel and steel both increased year-on-year

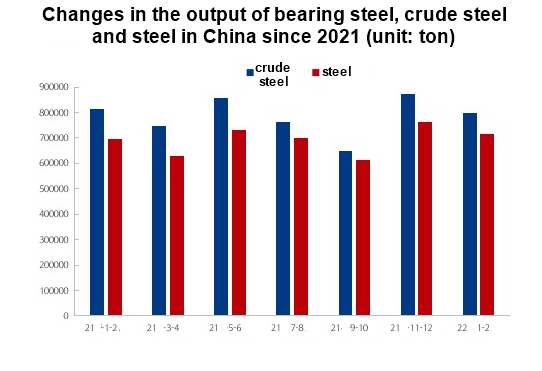

According to statistics from the Special Steel Association, from January to February 2022, the crude bearing steel output of my country's major high-quality special steel enterprises was 799,200 tons, an increase of 4.61% compared with the same period last year. From January to February 2022, the output of bearing steel of my country's major high-quality special steel enterprises was 714,000 tons, an increase of 9.55% compared with the same period last year. See Figure 1 for details.

(2) The output of finished products of bearing steel production enterprises from January to February 2022: the output of steel mills increased year-on-year

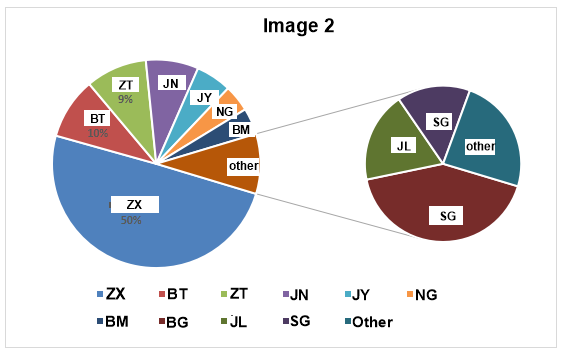

It can be seen from Figure 2 that at present, the largest production enterprises of bearing steel are: CITIC Special Steel (Xingcheng Special Steel, Daye Special Steel, Qingdao Iron and Steel), Hegang Shigang and Jiyuan Iron and Steel, accounting for 3% of the total output. 58%. From January to February 2022, the overall output of bearing steel is increasing, and the output of steel mills such as Shigang, Jiyuan, Laigang, Shagang, Zhongte, Nangang, and Zhongte have increased compared with the same period last year. The output of steel mills such as Neng and Nangang decreased.

2. The domestic bearing steel market performance

In March, the market price of bearing steel partially rose, the fundamentals performed poorly, and the industry profit level declined. In March, the new crown epidemic spread again, some cities stopped work and production, and transportation was seriously stagnant, which had a greater impact on the demand for steel, and the demand for bearing steel has been suppressed. In the recent stage, the confidence of market merchants is obviously insufficient, the current epidemic situation has not been effectively controlled, and the release of manufacturing demand is limited, and the full release may need to wait until mid-to-late April. In view of the continuous rise in raw material prices, the cost of steel mills is under great pressure, and steel mills are more willing to raise prices in the later period. In addition, as the cost of replenishing warehouses continues to rise, and low-priced resources in the market are decreasing, it is expected that the market price of bearing steel may increase slightly in April.

3. Relevant market information

(1) Raw material price:

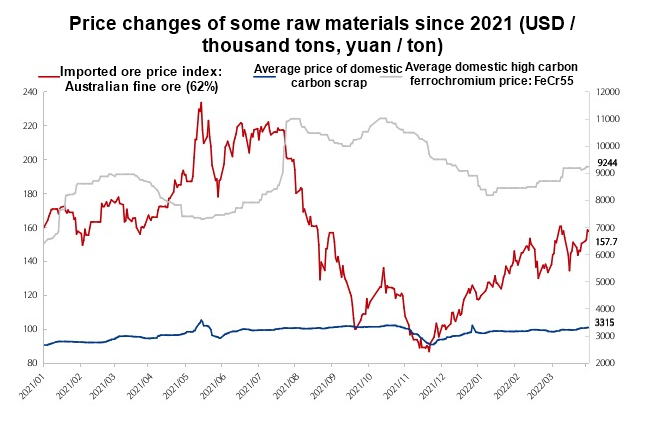

In March, iron ore as a whole dominated the above behavior, and the current 62% Australian powder index is US$157.7/dry ton. With the gradual weakening of environmental protection and production restrictions, the demand for iron ore has also entered a recovery cycle. In March, both supply and demand of iron ore increased, but the increase in demand was even greater, and the gap between supply and demand continued to narrow. Although the total inventory in April maintained the trend of destocking, the current port inventory is still at a high level, and the inventory of mainstream resources is also higher than that of the same period last year. The narrowing of the supply and demand gap has limited support for the formation of mining prices; The price is 3315 yuan / ton. Under the continuous influence of the tax reform policy, the cost of scrap steel has increased. And due to the continuous impact of the public health incident, the output, processing and transportation of scrap steel have been affected to varying degrees, the market for scrap steel resources is tight, and the inventory of steel mills continues to decline, which supports the price of scrap steel to rise; the market price of high-carbon ferrochromium is on the rise. The price is 9244 yuan / ton. Under the profit recovery, some factories resumed production as scheduled, and the production of high-carbon ferrochromium returned to a higher level in March. However, both upstream and downstream production have been hampered in some areas due to the epidemic, and stainless steel production fell in April, which weakened the demand for ferrochromium. The supply situation of high-carbon ferrochromium remains unchanged under the high production level, which may inhibit the upward speed of ferrochromium.

(2) Downstream industries:

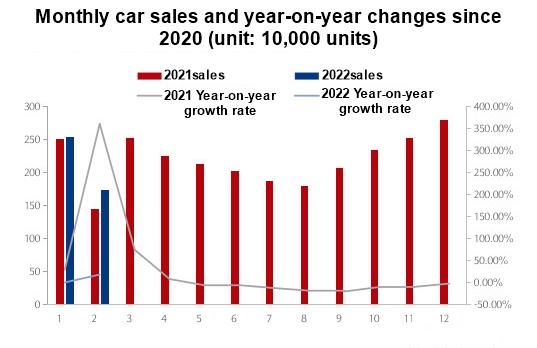

According to the statistical analysis of the China Association of Automobile Manufacturers, in February 2022, automobile production and sales reached 1.813 million and 1.737 million respectively, down 25.2% and 31.4% month-on-month, and up 20.6% and 18.7% year-on-year. From January to February, the production and sales of automobiles were 4.235 million and 4.268 million, up 8.8% and 7.5% year-on-year. Affected by the long Spring Festival holiday, the number of working days has decreased. In addition, the spread of the epidemic in some parts of the country has also affected the growth of automobile market demand to a certain extent. Therefore, the automobile production and sales cycle in February fell significantly, but showed a rapid growth year-on-year.

4. Conclusion

In March, the market price of bearing steel partially rose, and the recovery of demand was slow. Under the background of rising raw material prices, the cost of steel mills has also increased, but the performance of steel pipe mills and forging mills in the downstream industry is not satisfactory, and the motivation for the sharp rise in bearing steel prices in the later period is insufficient. In addition, some areas of the country have been greatly affected by the epidemic, and the confidence of market merchants is obviously insufficient. The terminal demand in April needs to be verified. Although the release of effective demand from downstream terminals is moderate, in view of the fact that the market cost support is still strong, as the cost of replenishing warehouses for merchants continues to rise in the later period, it is expected that the market price of bearing steel may still have some room for growth in April.

1.The news above mentioned with detailed source are from internet.We are trying our best to assure they are accurate ,timely and safe so as to let bearing users and sellers read more related info.However, it doesn't mean we agree with any point of view referred in above contents and we are not responsible for the authenticity. If you want to publish the news,please note the source and you will be legally responsible for the news published.

2.All news edited and translated by us are specially noted the source"CBCC".

3.For investors,please be cautious for all news.We don't bear any damage brought by late and inaccurate news.

4.If the news we published involves copyright of yours,just let us know.

Next Even pillow block bearings are getting environmental

BRIEF INTRODUCTION

Cnbearing is the No.1 bearing inquiry system and information service in China, dedicated to helping all bearing users and sellers throughout the world.

Cnbearing is supported by China National Bearing Industry Association, whose operation online is charged by China Bearing Unisun Tech. Co., Ltd.

China Bearing Unisun Tech. Co., Ltd owns all the rights. Since 2000, over 3,000 companies have been registered and enjoyed the company' s complete skillful service, which ranking many aspects in bearing industry at home and abroad with the most authority practical devices in China.