Monthly Summary: The trend of the bearing steel market prices may strengthen slightly after the bottom of the shock in June

Overview: From January to April 2022, domestic crude bearing steel output increased by 3.49% year-on-year, and bearing steel output increased by 7.70% year-on-year. Looking back at the bearing steel market in May, strong expectations are hard to match weak reality, and the market as a whole shows a weak downward trend. Up to now, the average price of domestic bearing round steel 50mm (continuous casting) is 6370 yuan/ton, down 187 yuan/ton from the end of April, and the month-on-month decrease is 2.85%. In May, Jiangyin and Shanghai, the main downstream distribution centers of bearing steel, were both affected by the epidemic, and the downstream demand was severely suppressed. The orders received by steel pipe factories and forging factories were weak, and it still took time to build business confidence. In June, with the lifting of Shanghai's epidemic control and favorable policies, the development situation of the automobile industry is gradually improving, and the manufacturing demand may gradually recover. It is expected that the bearing steel market price in June may strengthen slightly after the shock bottoms out.

1. Domestic production of bearing steel

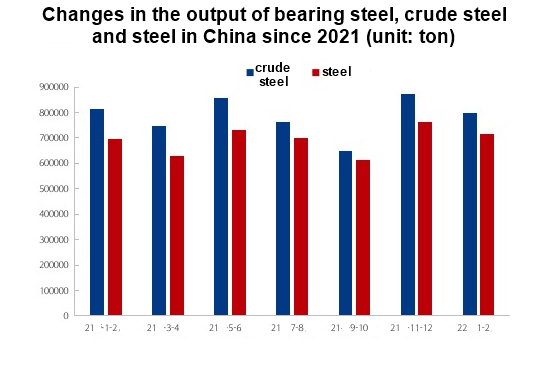

(1) Production of bearing steel from January to April 2022: crude steel and steel both increased year-on-year

According to the statistics of the Special Steel Association, from January to April 2022, the crude steel output of bearing steel of my country's major high-quality special steel enterprises was 1.6157 million tons, an increase of 3.49% compared with the same period last year; from January to April 2022, my country's main high-quality special steel The company's output of bearing steel was 1.4286 million tons, an increase of 7.70% compared with the same period last year. See Figure 1 for details.

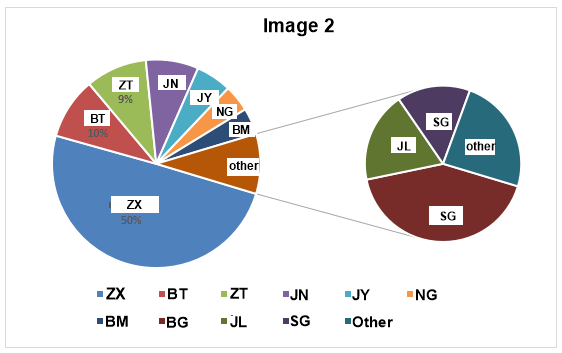

(2) The output of finished products of bearing steel production enterprises from January to April 2022: the output of steel mills increased year-on-year

It can be seen from Figure 2 that at present, the largest bearing steel production enterprises are: CITIC Special Steel (Xingcheng Special Steel, Daye Special Steel, Qingdao Iron and Steel), Jiyuan Steel and Hegang Stone Steel, accounting for 3% of the total output. 59%. From January to April 2022, the overall output of bearing steel will increase. The output of Neng, Nangang, Shagang and other steel mills decreased.

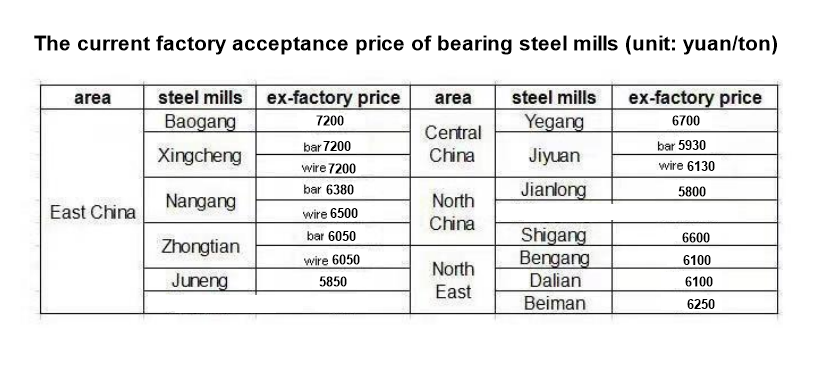

2. The domestic bearing steel market performance

In May, the market price of bearing steel showed a weak downward trend as a whole, and the downstream performance was still lower than expected. In the recent stage, the overall market inventory has been continuously accumulating. The pressure on the inventory of bearing steel pipe factories and forging factories has increased, and traders are more willing to lower the inventory and return funds. The positive sentiment established in the early stage of the market has suffered a significant blow, and it still takes time to build business confidence. With the improvement of the epidemic situation in June and the help of the national "steady growth" policy, the government will increase the supply of enterprises' resumption of work and production policies, and promote the recovery of demand. It is expected that the bearing steel market price in June is expected to strengthen slightly after the shock bottom.

3. Relevant market information

(1) Raw material price:

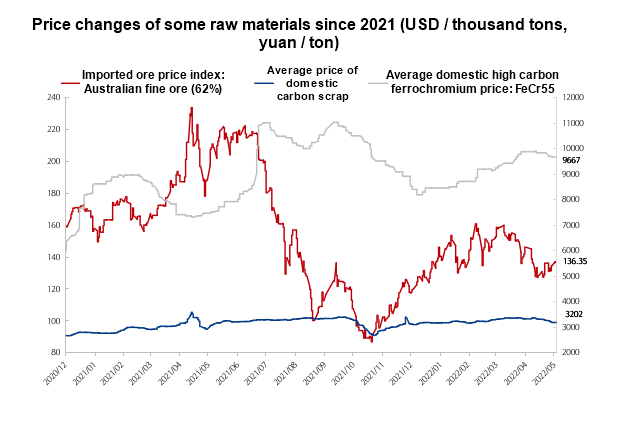

In May, iron ore prices fell first and then rose. Against the backdrop of a pessimistic overall sentiment, iron ore prices finally showed a downward trend. The current 62% Australian powder index is US$136.35/dry ton. As the domestic epidemic eases, the factors restricting mine production continue to weaken, and domestic iron ore concentrate production and inventory have also increased to a certain extent, and the overall supply of iron ore has continued to improve compared with April. It is expected that the supply of iron ore will further rebound in June, and the gap between supply and demand will shrink significantly. At the same time, it is necessary to pay more attention to the impact of changes in macro policies and the degree of recovery of downstream demand on the short-term price cycle; the domestic scrap steel market has fallen sharply, and the average price at the end of the month is 3202 yuan / Ton. Affected by the sharp drop in the prices of finished products and raw materials such as iron ore and coke, the scrap steel market was dragged down and followed suit. Entering June, with the gradual dissipation of the impact of the epidemic and various supportive policies in various regions, market confidence has recovered. At present, the pressure on the finished product inventory of steel mills is huge, and it still takes a certain period of time to consume the inventory. In addition, the rainy season in the south will increase demand. It must be restrained. Considering the gradual recovery of the market, it is expected that the scrap steel market will have room to rise after the pressure in June; the market price of high carbon ferrochromium is mainly volatile, and the price at the end of the month is 9667 yuan / ton. Due to the continued high cost and the limited replenishment of raw material inventories, this week began to reduce and stop production and avoid peak production. Some in-production companies have also extended the time for inspection and production. It is expected that the output will decline significantly in June. However, in June, the downstream production scheduling plan will decrease even more, and the supply and demand situation may change. In the later stage, the market will mainly focus on cost changes and downstream consumer demand. It is expected that the ferrochromium market will maintain stable operation in the short term.

(2) Downstream industries

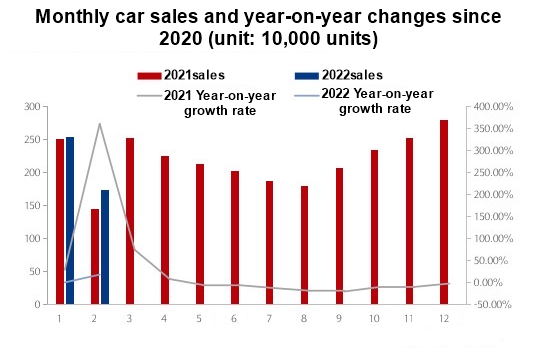

According to the statistical analysis of the China Association of Automobile Manufacturers, in April 2022, due to factors such as the spread of the domestic epidemic, the production and sales of automobiles reached 1.205 million and 1.181 million respectively, down 46.2% and 47.1% month-on-month and 46.1% and 46.1% year-on-year respectively. 47.6%. From January to April, automobile production and sales reached 7.690 million and 7.691 million respectively, down 10.5% and 12.1% year-on-year.

4. Conclusion

In May, the market price of bearing steel showed a weak downward trend as a whole, and the overall sentiment of the market was relatively pessimistic. Affected by the epidemic, logistics in some areas was not smooth, and downstream demand was still constrained to a certain extent. The performance of downstream industries such as automotive bearings, wind power bearings, and metallurgical bearings was unsatisfactory. Steel mills and social inventories continued to accumulate. Some bearing steel production enterprises have high output. Under the condition of high inventory, capital flow and risk control are particularly important. At present, the price difference between GCr15 and 45# carbon steel has widened, and the price difference of some steel mills has reached 600-800 yuan / ton. End users are more cautious in purchasing, and downstream concerns still exist. The effect of macroeconomic policies on consumption stimulation will appear, and consumption in June will be better than that in May. It is expected that the market price of bearing steel in June is expected to strengthen slightly after the shock bottoms out.

1.The news above mentioned with detailed source are from internet.We are trying our best to assure they are accurate ,timely and safe so as to let bearing users and sellers read more related info.However, it doesn't mean we agree with any point of view referred in above contents and we are not responsible for the authenticity. If you want to publish the news,please note the source and you will be legally responsible for the news published.

2.All news edited and translated by us are specially noted the source"CBCC".

3.For investors,please be cautious for all news.We don't bear any damage brought by late and inaccurate news.

4.If the news we published involves copyright of yours,just let us know.

Next Even pillow block bearings are getting environmental

BRIEF INTRODUCTION

Cnbearing is the No.1 bearing inquiry system and information service in China, dedicated to helping all bearing users and sellers throughout the world.

Cnbearing is supported by China National Bearing Industry Association, whose operation online is charged by China Bearing Unisun Tech. Co., Ltd.

China Bearing Unisun Tech. Co., Ltd owns all the rights. Since 2000, over 3,000 companies have been registered and enjoyed the company' s complete skillful service, which ranking many aspects in bearing industry at home and abroad with the most authority practical devices in China.