RBC Bearings Incorporated Announces Fiscal 2014 Second Quarter Results

(1) Results exclude items in reconciliation below.

“Our second quarter results continue to reflect strong execution and increasing aerospace volumes,” said Dr. Michael J. Hartnett, Chairman and Chief Executive Officer. “Additionally, we are encouraged to see the sequential strengthening and improved execution of our industrial business.”

Second Quarter Results

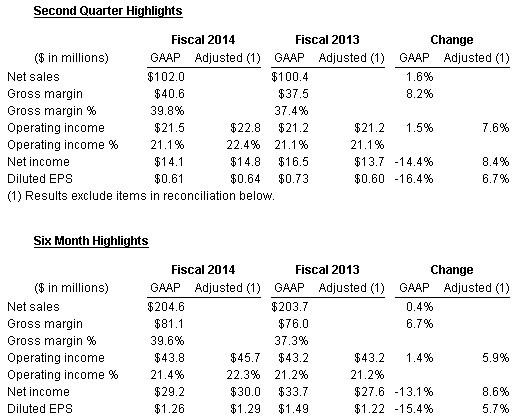

Net sales for the second quarter of fiscal 2014 were $102.0 million, an increase of 1.6% from $100.4 million in the second quarter of fiscal 2013. The increase in net sales was mainly the result of a 15.2% increase in aerospace and defense driven by commercial aircraft build rates, the aerospace aftermarket, and the inclusion of WPA. This was offset by a 12.8% decline in industrial sales driven by minimal activity in military vehicles, a decline in mining and construction activity on a year over year basis and the inclusion of CMP. Excluding military vehicles of $4.2 million, the decline in industrial sales would have been 4.7% mainly driven by the OEM business. Gross margin for the second quarter was $40.6 million compared to $37.5 million for the same period last year. Gross margin as a percentage of net sales was 39.8% in the second quarter of fiscal 2014 compared to 37.4% for the same period last year.

SG&A for the second quarter of fiscal 2014 was $17.1 million, an increase of $1.3 million over $15.8 million for the same period last year. The increase of $1.3 million was primarily attributable to an increase of $0.3 million in personnel-related expenses, $0.3 million in professional fees, $0.2 million in incentive stock compensation expenses, $0.1 million in other items, and $0.4 million associated with the addition of two acquisitions. As a percentage of net sales, SG&A was 16.8% for the second quarter of fiscal 2014 compared to 15.7% for the same period last year.

Other operating expenses for the second quarter of fiscal 2014 totaled $1.9 million, an increase of $1.3 million, compared to $0.6 million for the same period last year. For the second quarter of fiscal 2014 other operating expenses consisted of $0.4 million of amortization of intangibles, $0.9 million in costs associated with the consolidation and restructuring of large bearings facilities, $0.4 million of costs associated with acquisitions, and $0.2 million of other professional expenses. For the same period last year, other operating expenses consisted of $0.4 million of amortization of intangibles and $0.2 million of other items.

Operating income for the second quarter of fiscal 2014 was $21.5 million compared to operating income of $21.2 million for the same period last year. As a percentage of net sales, operating income was 21.1% compared to 21.1% for the same period last year. Excluding costs associated with the consolidation and restructuring of large bearing facilities, acquisition costs, and disposal of fixed assets, operating income would have been $22.8 million for the second quarter of fiscal 2014 compared to $21.2 million for the same period last year. Excluding these adjustments, operating income as a percentage of net sales would have been 22.4% compared to 21.1 % for the same period last year.

Interest expense, net for the second quarter of fiscal 2014 was $0.3 million compared to $0.2 million for the same period last year.

Income tax expense for the second quarter of fiscal 2014 was $7.2 million compared to $4.4 million for the same period last year. Our effective income tax rate for the second quarter of fiscal 2014 was 33.6% compared to 21.1% for the same period last year. The effective income tax rates for the second quarter of fiscal 2014 and 2013 include a $0.2 million and $2.8 million benefit due to the reversal of unrecognized tax benefits associated with the conclusion of state and federal income tax audits. The effective income tax rates without these discrete items would have been 34.4% and 34.7% for the second quarter of fiscal 2014 and 2013, respectively.

Net income for the second quarter of fiscal 2014 was $14.1 million compared to $16.5 million for the same period last year. Excluding the after tax impact of costs associated with consolidation and restructuring of large bearing facilities, acquisition costs, disposal of fixed assets, and the discrete tax benefits, net income would have been $14.8 million for the second quarter of fiscal 2014, compared to an adjusted net income of $13.7 million for the same period last year.

Diluted EPS for the second quarter of fiscal 2014 was 61 cents per share compared to 73 cents per share for the same period last year. Excluding the after tax impact of costs associated with consolidation and restructuring of large bearing facilities, acquisition costs, disposal of fixed assets and the discrete tax benefits, diluted EPS for the second quarter of fiscal 2014 would have been 64 cents per share compared to an adjusted diluted EPS of 60 cents per share for the same period last year, an increase of 6.7%.

Backlog, as of September 28, 2013, was $222.3 million compared to $216.1 million as of September 29, 2012.

Acquisitions

On October 7, 2013, the Company completed the acquisition of the net assets of Turbine Components Inc. (“TCI”) for approximately $3.9 million. TCI, located in San Diego, California, is an FAA certified aircraft gas turbine repair station and manufacturer of precision components for the aerospace markets.

On August 16, 2013, the Company completed the acquisition of Climax Metal Products Company (“CMP”) for approximately $13.6 million. CMP, located in Mentor, Ohio, is a manufacturer of precision shaft collars, rigid couplings, keyless locking devices, and bearings for the industrial markets.

Live Webcast

RBC Bearings Incorporated will host a webcast at 11:00 a.m. ET today to discuss the quarterly results. To access the webcast, go to the investor relations portion of the Company’s website, www.rbcbearings.com, and click on the webcast icon. If you do not have access to the Internet and wish to listen to the call, dial 877-546-5019 (international callers dial 857-244-7551) and enter conference ID # 26122396. An audio replay of the call will be available from 3:00 p.m. ET on Thursday, November 7th until 11:59 p.m. ET on Thursday, November 14th. The replay can be accessed by dialing 888-286-8010 (international callers dial 617-801-6888) and entering conference call ID # 85113337. Investors are advised to dial into the call at least ten minutes prior to the call to register.

Non-GAAP Financial Measures

In addition to disclosing results of operations that are determined in accordance with generally accepted accounting principles (“GAAP”), this press release also discloses non-GAAP results of operations that exclude certain items. These non-GAAP measures adjust for items that Management believes are unusual. Management believes that the presentation of these non-GAAP measures provides useful information to investors regarding the Company’s results of operations, as these non-GAAP measures allow investors to better evaluate ongoing business performance. Investors should consider non-GAAP measures in addition to, not as a substitute for, financial measures prepared in accordance with GAAP. A reconciliation of the non-GAAP measures disclosed in the press release with the most comparable GAAP measures are included in the financial table attached to this press release.

About RBC Bearings

RBC Bearings Incorporated is an international manufacturer and marketer of highly engineered precision bearings and components. Founded in 1919, the Company is primarily focused on producing highly technical or regulated bearing products requiring sophisticated design, testing, and manufacturing capabilities for the diversified industrial, aerospace, and defense markets. Headquartered in Oxford, Connecticut, RBC Bearings currently employs approximately 2,233 people and operates 25 manufacturing facilities in four countries.

Safe Harbor for Forward Looking Statements

Certain statements in this press release contain “forward-looking statements.” All statements other than statements of historical fact are “forward-looking statements” for purposes of federal and state securities laws, including the section of this press release entitled “Outlook”; any projections of earnings, revenue or other financial items relating to the Company, any statement of the plans, strategies and objectives of management for future operations; any statements concerning proposed future growth rates in the markets we serve; any statements of belief; any characterization of and the Company’s ability to control contingent liabilities; anticipated trends in the Company’s businesses; and any statements of assumptions underlying any of the foregoing. Forward-looking statements may include the words “may,” “estimate,” “intend,” “continue,” “believe,” “expect,” “anticipate,” and other similar words. Although the Company believes that the expectations reflected in any forward-looking statements are reasonable, actual results could differ materially from those projected or assumed in any of our forward-looking statements. Our future financial condition and results of operations, as well as any forward-looking statements, are subject to change and to inherent risks and uncertainties beyond the control of the Company. These risks and uncertainties include, but are not limited to, risks and uncertainties relating to general economic conditions, geopolitical factors, future levels of general industrial manufacturing activity, future financial performance, market acceptance of new or enhanced versions of the Company’s products, the pricing of raw materials, changes in the competitive environments in which the Company’s businesses operate, the outcome of pending or future litigation and governmental proceedings and approvals, estimated legal costs, increases in interest rates, the Company’s ability to meet its debt obligations, and risks and uncertainties listed or disclosed in the Company’s reports filed with the Securities and Exchange Commission, including, without limitation, the risks identified under the heading “Risk Factors” set forth in the Company’s most recent Annual Report filed on Form 10-K. The Company does not intend, and undertakes no obligation, to update or alter any forward-looking statements.

(1) Results exclude items in reconciliation below.

“Our second quarter results continue to reflect strong execution and increasing aerospace volumes,” said Dr. Michael J. Hartnett, Chairman and Chief Executive Officer. “Additionally, we are encouraged to see the sequential strengthening and improved execution of our industrial business.”

Second Quarter Results

Net sales for the second quarter of fiscal 2014 were $102.0 million, an increase of 1.6% from $100.4 million in the second quarter of fiscal 2013. The increase in net sales was mainly the result of a 15.2% increase in aerospace and defense driven by commercial aircraft build rates, the aerospace aftermarket, and the inclusion of WPA. This was offset by a 12.8% decline in industrial sales driven by minimal activity in military vehicles, a decline in mining and construction activity on a year over year basis and the inclusion of CMP. Excluding military vehicles of $4.2 million, the decline in industrial sales would have been 4.7% mainly driven by the OEM business. Gross margin for the second quarter was $40.6 million compared to $37.5 million for the same period last year. Gross margin as a percentage of net sales was 39.8% in the second quarter of fiscal 2014 compared to 37.4% for the same period last year.

SG&A for the second quarter of fiscal 2014 was $17.1 million, an increase of $1.3 million over $15.8 million for the same period last year. The increase of $1.3 million was primarily attributable to an increase of $0.3 million in personnel-related expenses, $0.3 million in professional fees, $0.2 million in incentive stock compensation expenses, $0.1 million in other items, and $0.4 million associated with the addition of two acquisitions. As a percentage of net sales, SG&A was 16.8% for the second quarter of fiscal 2014 compared to 15.7% for the same period last year.

Other operating expenses for the second quarter of fiscal 2014 totaled $1.9 million, an increase of $1.3 million, compared to $0.6 million for the same period last year. For the second quarter of fiscal 2014 other operating expenses consisted of $0.4 million of amortization of intangibles, $0.9 million in costs associated with the consolidation and restructuring of large bearings facilities, $0.4 million of costs associated with acquisitions, and $0.2 million of other professional expenses. For the same period last year, other operating expenses consisted of $0.4 million of amortization of intangibles and $0.2 million of other items.

Operating income for the second quarter of fiscal 2014 was $21.5 million compared to operating income of $21.2 million for the same period last year. As a percentage of net sales, operating income was 21.1% compared to 21.1% for the same period last year. Excluding costs associated with the consolidation and restructuring of large bearing facilities, acquisition costs, and disposal of fixed assets, operating income would have been $22.8 million for the second quarter of fiscal 2014 compared to $21.2 million for the same period last year. Excluding these adjustments, operating income as a percentage of net sales would have been 22.4% compared to 21.1 % for the same period last year.

Interest expense, net for the second quarter of fiscal 2014 was $0.3 million compared to $0.2 million for the same period last year.

Income tax expense for the second quarter of fiscal 2014 was $7.2 million compared to $4.4 million for the same period last year. Our effective income tax rate for the second quarter of fiscal 2014 was 33.6% compared to 21.1% for the same period last year. The effective income tax rates for the second quarter of fiscal 2014 and 2013 include a $0.2 million and $2.8 million benefit due to the reversal of unrecognized tax benefits associated with the conclusion of state and federal income tax audits. The effective income tax rates without these discrete items would have been 34.4% and 34.7% for the second quarter of fiscal 2014 and 2013, respectively.

Net income for the second quarter of fiscal 2014 was $14.1 million compared to $16.5 million for the same period last year. Excluding the after tax impact of costs associated with consolidation and restructuring of large bearing facilities, acquisition costs, disposal of fixed assets, and the discrete tax benefits, net income would have been $14.8 million for the second quarter of fiscal 2014, compared to an adjusted net income of $13.7 million for the same period last year.

Diluted EPS for the second quarter of fiscal 2014 was 61 cents per share compared to 73 cents per share for the same period last year. Excluding the after tax impact of costs associated with consolidation and restructuring of large bearing facilities, acquisition costs, disposal of fixed assets and the discrete tax benefits, diluted EPS for the second quarter of fiscal 2014 would have been 64 cents per share compared to an adjusted diluted EPS of 60 cents per share for the same period last year, an increase of 6.7%.

Backlog, as of September 28, 2013, was $222.3 million compared to $216.1 million as of September 29, 2012.

Acquisitions

On October 7, 2013, the Company completed the acquisition of the net assets of Turbine Components Inc. (“TCI”) for approximately $3.9 million. TCI, located in San Diego, California, is an FAA certified aircraft gas turbine repair station and manufacturer of precision components for the aerospace markets.

On August 16, 2013, the Company completed the acquisition of Climax Metal Products Company (“CMP”) for approximately $13.6 million. CMP, located in Mentor, Ohio, is a manufacturer of precision shaft collars, rigid couplings, keyless locking devices, and bearings for the industrial markets.

Live Webcast

RBC Bearings Incorporated will host a webcast at 11:00 a.m. ET today to discuss the quarterly results. To access the webcast, go to the investor relations portion of the Company’s website, www.rbcbearings.com, and click on the webcast icon. If you do not have access to the Internet and wish to listen to the call, dial 877-546-5019 (international callers dial 857-244-7551) and enter conference ID # 26122396. An audio replay of the call will be available from 3:00 p.m. ET on Thursday, November 7th until 11:59 p.m. ET on Thursday, November 14th. The replay can be accessed by dialing 888-286-8010 (international callers dial 617-801-6888) and entering conference call ID # 85113337. Investors are advised to dial into the call at least ten minutes prior to the call to register.

Non-GAAP Financial Measures

In addition to disclosing results of operations that are determined in accordance with generally accepted accounting principles (“GAAP”), this press release also discloses non-GAAP results of operations that exclude certain items. These non-GAAP measures adjust for items that Management believes are unusual. Management believes that the presentation of these non-GAAP measures provides useful information to investors regarding the Company’s results of operations, as these non-GAAP measures allow investors to better evaluate ongoing business performance. Investors should consider non-GAAP measures in addition to, not as a substitute for, financial measures prepared in accordance with GAAP. A reconciliation of the non-GAAP measures disclosed in the press release with the most comparable GAAP measures are included in the financial table attached to this press release.

About RBC Bearings

RBC Bearings Incorporated is an international manufacturer and marketer of highly engineered precision bearings and components. Founded in 1919, the Company is primarily focused on producing highly technical or regulated bearing products requiring sophisticated design, testing, and manufacturing capabilities for the diversified industrial, aerospace, and defense markets. Headquartered in Oxford, Connecticut, RBC Bearings currently employs approximately 2,233 people and operates 25 manufacturing facilities in four countries.

Safe Harbor for Forward Looking Statements

Certain statements in this press release contain “forward-looking statements.” All statements other than statements of historical fact are “forward-looking statements” for purposes of federal and state securities laws, including the section of this press release entitled “Outlook”; any projections of earnings, revenue or other financial items relating to the Company, any statement of the plans, strategies and objectives of management for future operations; any statements concerning proposed future growth rates in the markets we serve; any statements of belief; any characterization of and the Company’s ability to control contingent liabilities; anticipated trends in the Company’s businesses; and any statements of assumptions underlying any of the foregoing. Forward-looking statements may include the words “may,” “estimate,” “intend,” “continue,” “believe,” “expect,” “anticipate,” and other similar words. Although the Company believes that the expectations reflected in any forward-looking statements are reasonable, actual results could differ materially from those projected or assumed in any of our forward-looking statements. Our future financial condition and results of operations, as well as any forward-looking statements, are subject to change and to inherent risks and uncertainties beyond the control of the Company. These risks and uncertainties include, but are not limited to, risks and uncertainties relating to general economic conditions, geopolitical factors, future levels of general industrial manufacturing activity, future financial performance, market acceptance of new or enhanced versions of the Company’s products, the pricing of raw materials, changes in the competitive environments in which the Company’s businesses operate, the outcome of pending or future litigation and governmental proceedings and approvals, estimated legal costs, increases in interest rates, the Company’s ability to meet its debt obligations, and risks and uncertainties listed or disclosed in the Company’s reports filed with the Securities and Exchange Commission, including, without limitation, the risks identified under the heading “Risk Factors” set forth in the Company’s most recent Annual Report filed on Form 10-K. The Company does not intend, and undertakes no obligation, to update or alter any forward-looking statements.

1.The news above mentioned with detailed source are from internet.We are trying our best to assure they are accurate ,timely and safe so as to let bearing users and sellers read more related info.However, it doesn't mean we agree with any point of view referred in above contents and we are not responsible for the authenticity. If you want to publish the news,please note the source and you will be legally responsible for the news published.

2.All news edited and translated by us are specially noted the source"CBCC".

3.For investors,please be cautious for all news.We don't bear any damage brought by late and inaccurate news.

4.If the news we published involves copyright of yours,just let us know.

Next SKF sour gas compressor bearings last up to ten times longer

BRIEF INTRODUCTION

Cnbearing is the No.1 bearing inquiry system and information service in China, dedicated to helping all bearing users and sellers throughout the world.

Cnbearing is supported by China National Bearing Industry Association, whose operation online is charged by China Bearing Unisun Tech. Co., Ltd.

China Bearing Unisun Tech. Co., Ltd owns all the rights. Since 2000, over 3,000 companies have been registered and enjoyed the company' s complete skillful service, which ranking many aspects in bearing industry at home and abroad with the most authority practical devices in China.