RBC Bearings Inc (NASDAQ:ROLL) Quarterly Sentiment Change Report

RBC Bearings Inc (NASDAQ:ROLL) institutional sentiment increased to 1.72 in Q2 2017. Its up 0.43, from 1.29 in 2017Q1. The ratio has increased, as 86 investment managers increased and started new stock positions, while 50 sold and reduced positions in RBC Bearings Inc. The investment managers in our partner’s database now hold: 23.77 million shares, down from 23.87 million shares in 2017Q1. Also, the number of investment managers holding RBC Bearings Inc in their top 10 stock positions decreased from 3 to 2 for a decrease of 1. Sold All: 8 Reduced: 42 Increased: 65 New Position: 21.

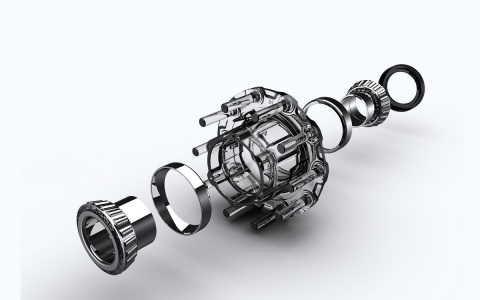

RBC Bearings Incorporated is an international maker and marketer of engineered precision bearings and products, which are integral to the manufacture and operation of machines, aircraft and mechanical systems. The company has market cap of $2.99 billion. The Firm operates through four divisions: Plain Bearings; Roller Bearings; Ball Bearings, and Engineered Products. It has a 39.72 P/E ratio. The Firm has over 40 facilities of which over 30 are manufacturing facilities in approximately five countries.

About 22,892 shares traded. RBC Bearings Incorporated (NASDAQ:ROLL) has risen 38.75% since September 27, 2016 and is uptrending. It has outperformed by 22.05% the S&P500.

Wall Street await RBC Bearings Incorporated (NASDAQ:ROLL) to release earnings on November, 2. Analysts forecast EPS of $0.85, up exactly $0.07 or 8.97 % from 2014’s $0.78 EPS. The expected ROLL’s profit could reach $20.60 million giving the stock 36.29 P/E in the case that $0.85 earnings per share is reported. After posting $0.91 EPS for the previous quarter, RBC Bearings Incorporated’s analysts now forecast -6.59 % negative EPS growth.

Snyder Capital Management L P holds 3.54% of its portfolio in RBC Bearings Incorporated for 656,469 shares. Rk Capital Management Llc owns 114,109 shares or 2.34% of their US portfolio. Moreover, Kayne Anderson Rudnick Investment Management Llc has 2.29% invested in the company for 2.26 million shares. The Washington-based Harbour Investment Management Llc has invested 1.69% in the stock. Wasatch Advisors Inc, a Utah-based fund reported 858,702 shares.

Since January 1, 0001, it had 0 buys, and 8 selling transactions for $8.62 million activity.

RBC Bearings Inc (NASDAQ:ROLL) institutional sentiment increased to 1.72 in Q2 2017. Its up 0.43, from 1.29 in 2017Q1. The ratio has increased, as 86 investment managers increased and started new stock positions, while 50 sold and reduced positions in RBC Bearings Inc. The investment managers in our partner’s database now hold: 23.77 million shares, down from 23.87 million shares in 2017Q1. Also, the number of investment managers holding RBC Bearings Inc in their top 10 stock positions decreased from 3 to 2 for a decrease of 1. Sold All: 8 Reduced: 42 Increased: 65 New Position: 21.

RBC Bearings Incorporated is an international maker and marketer of engineered precision bearings and products, which are integral to the manufacture and operation of machines, aircraft and mechanical systems. The company has market cap of $2.99 billion. The Firm operates through four divisions: Plain Bearings; Roller Bearings; Ball Bearings, and Engineered Products. It has a 39.72 P/E ratio. The Firm has over 40 facilities of which over 30 are manufacturing facilities in approximately five countries.

About 22,892 shares traded. RBC Bearings Incorporated (NASDAQ:ROLL) has risen 38.75% since September 27, 2016 and is uptrending. It has outperformed by 22.05% the S&P500.

Wall Street await RBC Bearings Incorporated (NASDAQ:ROLL) to release earnings on November, 2. Analysts forecast EPS of $0.85, up exactly $0.07 or 8.97 % from 2014’s $0.78 EPS. The expected ROLL’s profit could reach $20.60 million giving the stock 36.29 P/E in the case that $0.85 earnings per share is reported. After posting $0.91 EPS for the previous quarter, RBC Bearings Incorporated’s analysts now forecast -6.59 % negative EPS growth.

Snyder Capital Management L P holds 3.54% of its portfolio in RBC Bearings Incorporated for 656,469 shares. Rk Capital Management Llc owns 114,109 shares or 2.34% of their US portfolio. Moreover, Kayne Anderson Rudnick Investment Management Llc has 2.29% invested in the company for 2.26 million shares. The Washington-based Harbour Investment Management Llc has invested 1.69% in the stock. Wasatch Advisors Inc, a Utah-based fund reported 858,702 shares.

Since January 1, 0001, it had 0 buys, and 8 selling transactions for $8.62 million activity.

1.The news above mentioned with detailed source are from internet.We are trying our best to assure they are accurate ,timely and safe so as to let bearing users and sellers read more related info.However, it doesn't mean we agree with any point of view referred in above contents and we are not responsible for the authenticity. If you want to publish the news,please note the source and you will be legally responsible for the news published.

2.All news edited and translated by us are specially noted the source"CBCC".

3.For investors,please be cautious for all news.We don't bear any damage brought by late and inaccurate news.

4.If the news we published involves copyright of yours,just let us know.

Next Accuride Launches ROLLiant™ Hub System From KIC

BRIEF INTRODUCTION

Cnbearing is the No.1 bearing inquiry system and information service in China, dedicated to helping all bearing users and sellers throughout the world.

Cnbearing is supported by China National Bearing Industry Association, whose operation online is charged by China Bearing Unisun Tech. Co., Ltd.

China Bearing Unisun Tech. Co., Ltd owns all the rights. Since 2000, over 3,000 companies have been registered and enjoyed the company' s complete skillful service, which ranking many aspects in bearing industry at home and abroad with the most authority practical devices in China.