Contrasting AB SKF (SKFRY) and The Timken (TKR)

AB SKF has a beta of 0.64, meaning that its share price is 36% less volatile than the S&P 500. Comparatively, The Timken has a beta of 1.55, meaning that its share price is 55% more volatile than the S&P 500.

Insider and Institutional Ownership

0.5% of AB SKF shares are held by institutional investors. Comparatively, 79.5% of The Timken shares are held by institutional investors. 11.1% of The Timken shares are held by insiders. Strong institutional ownership is an indication that large money managers, endowments and hedge funds believe a stock will outperform the market over the long term.

Valuation & Earnings

This table compares AB SKF and The Timken’s revenue, earnings per share (EPS) and valuation.

AB SKF has higher revenue and earnings than The Timken. AB SKF is trading at a lower price-to-earnings ratio than The Timken, indicating that it is currently the more affordable of the two stocks.

Dividends

AB SKF pays an annual dividend of $0.51 per share and has a dividend yield of 2.4%. The Timken pays an annual dividend of $1.08 per share and has a dividend yield of 2.2%. AB SKF pays out 36.2% of its earnings in the form of a dividend. The Timken pays out 42.0% of its earnings in the form of a dividend. Both companies have healthy payout ratios and should be able to cover their dividend payments with earnings for the next several years. The Timken has increased its dividend for 4 consecutive years. AB SKF is clearly the better dividend stock, given its higher yield and lower payout ratio.

Analyst Ratings

This is a breakdown of recent recommendations for AB SKF and The Timken, as reported by MarketBeat.

The Timken has a consensus price target of $51.00, suggesting a potential upside of 4.83%. Given The Timken’s stronger consensus rating and higher possible upside, analysts plainly believe The Timken is more favorable than AB SKF.

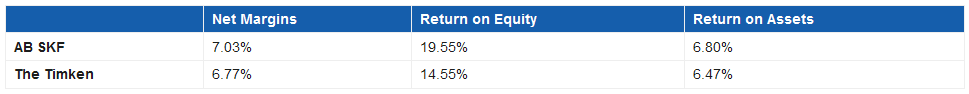

Profitability

This table compares AB SKF and The Timken’s net margins, return on equity and return on assets.

1.The news above mentioned with detailed source are from internet.We are trying our best to assure they are accurate ,timely and safe so as to let bearing users and sellers read more related info.However, it doesn't mean we agree with any point of view referred in above contents and we are not responsible for the authenticity. If you want to publish the news,please note the source and you will be legally responsible for the news published.

2.All news edited and translated by us are specially noted the source"CBCC".

3.For investors,please be cautious for all news.We don't bear any damage brought by late and inaccurate news.

4.If the news we published involves copyright of yours,just let us know.

Next RBC Bearings (ROLL) Stock Rating Upgraded by BidaskClub

BRIEF INTRODUCTION

Cnbearing is the No.1 bearing inquiry system and information service in China, dedicated to helping all bearing users and sellers throughout the world.

Cnbearing is supported by China National Bearing Industry Association, whose operation online is charged by China Bearing Unisun Tech. Co., Ltd.

China Bearing Unisun Tech. Co., Ltd owns all the rights. Since 2000, over 3,000 companies have been registered and enjoyed the company' s complete skillful service, which ranking many aspects in bearing industry at home and abroad with the most authority practical devices in China.