Those Who Purchased NRB Industrial Bearings (NSE:NIBL) Shares Three Years Ago Have A 55% Loss To Show For It

If you love investing in stocks you’re bound to buy some losers. But long term NRB Industrial Bearings Limited(NSE:NIBL) shareholders have had a particularly rough ride in the last three year. Unfortunately, they have held through a 55% decline in the share price in that time. It’s down 2.4% in the last seven days.

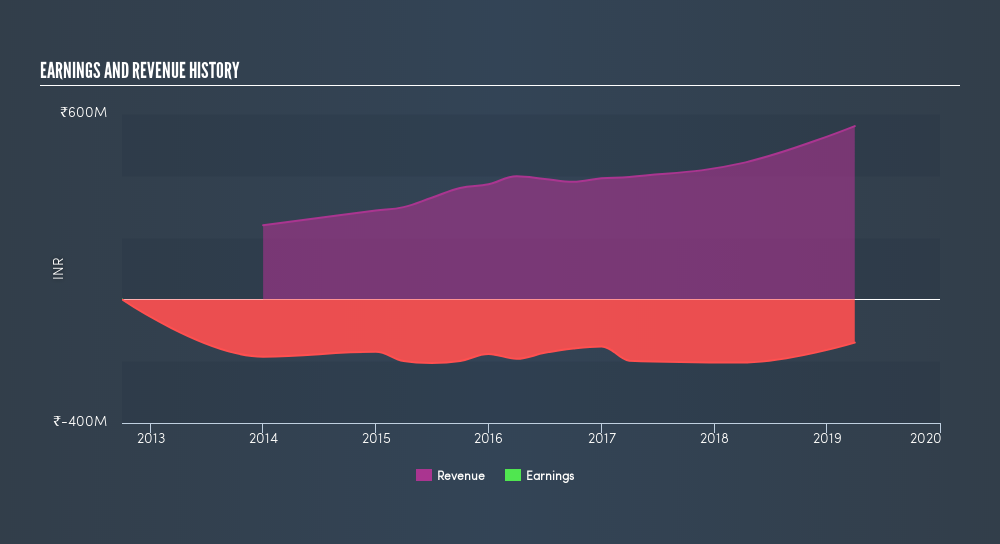

NRB Industrial Bearings isn’t a profitable company, so it is unlikely we’ll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That’s because it’s hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last three years, NRB Industrial Bearings saw its revenue grow by 13% per year, compound. That’s a fairly respectable growth rate. That contrasts with the weak share price, which has fallen 23% compounded, over three years. To be frank we’re surprised to see revenue growth and share price growth diverge so strongly. It would be well worth taking a closer look at the company, to determine growth trends (and balance sheet strength).

Depicted in the graphic below, you’ll see revenue and earnings over time. If you want more detail, you can click on the chart itself.

A Different Perspective

Investors in NRB Industrial Bearings had a tough year, with a total loss of 9.1%, against a market gain of about 0.9%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Longer term investors wouldn’t be so upset, since they would have made 6.1%, each year, over five years. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering.

1.The news above mentioned with detailed source are from internet.We are trying our best to assure they are accurate ,timely and safe so as to let bearing users and sellers read more related info.However, it doesn't mean we agree with any point of view referred in above contents and we are not responsible for the authenticity. If you want to publish the news,please note the source and you will be legally responsible for the news published.

2.All news edited and translated by us are specially noted the source"CBCC".

3.For investors,please be cautious for all news.We don't bear any damage brought by late and inaccurate news.

4.If the news we published involves copyright of yours,just let us know.

Next Innovative Automotive Bearing Solutions Designed to Cater Transforming Consumer Needs; Ball Bearings to Capture Spotlight

BRIEF INTRODUCTION

Cnbearing is the No.1 bearing inquiry system and information service in China, dedicated to helping all bearing users and sellers throughout the world.

Cnbearing is supported by China National Bearing Industry Association, whose operation online is charged by China Bearing Unisun Tech. Co., Ltd.

China Bearing Unisun Tech. Co., Ltd owns all the rights. Since 2000, over 3,000 companies have been registered and enjoyed the company' s complete skillful service, which ranking many aspects in bearing industry at home and abroad with the most authority practical devices in China.