Financial Performance Overview of Listed Chinese Pump Companies in H1 2025

In late August, domestic listed water pump companies successively released their 2025 semi-annual performance financial reports. Pump Friends Circle sorted out relevant data such as revenue and profits of some companies based on the annual reports. The following is a comprehensive report of 9 companies, covering horizontal comparisons and data sorting of each company one by one.

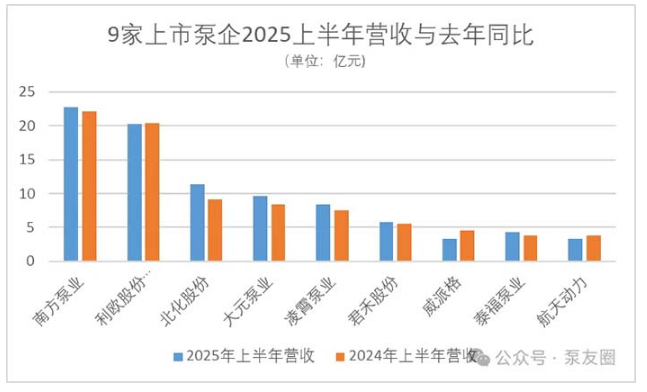

1. Comparison of the performance of 9 listed pump companies in the first half of 2025

Note:

This table includes only the machinery manufacturing business segments of Leo Pump Industry and Leo Group, which primarily include civil pumps, industrial pumps, and garden machinery and accessories. However, the specific profit figures for these segments are unknown.

2. Revenue Analysis

In terms of pump business revenue, in the first half of 2025, Southern Pump Industry, Leo Group's machinery manufacturing business segment, and Beihua Group held the top three positions. Southern Pump Industry achieved revenue of 2.271 billion yuan in the first half of 2025, while Leo Group's machinery manufacturing business segment generated 2.022 billion yuan. Beihua Group jumped to third place compared to the previous year, with revenue of 1.131 billion yuan in the first half of 2025.

Comparing first-half revenue to the same period last year, Beihua Group saw the highest growth, reaching 23.82%. Dayuan Pump Industry, Lingxiao Pump Industry, Taifu Pump Industry, and Leo Pump Industry all saw significant increases, at 14.55%, 11.57%, and 10.95%, respectively.

Note: In this table, Leo Pump Industry (Leo Group) only includes the machinery manufacturing business segment.

In terms of net profit, Lingxiao Pump Industry achieved approximately 234 million yuan in net profit attributable to parent company shareholders, followed closely by Southern Pump Industry and Beihua Group, with net profits attributable to parent company shareholders of 164.9 million yuan and 107 million yuan, respectively.

Data Analysis of 3.9 Listed Pump Companies

Leo Group

Leo Group achieved operating revenue of 9.635 billion yuan in the first half of 2025, a decrease of 9.62% year-on-year; net profit attributable to shareholders of the listed company was 478 million yuan, an increase of 164.28% year-on-year.

According to the table, the machinery manufacturing segment of Leo Group, the focus of this review, achieved operating revenue of 2.021 billion yuan, a year-on-year decrease of 0.81%. Steady progress in domestic market expansion and sustained growth in overseas business have contributed to the continuous optimization of its international presence and enhanced global market competitiveness.

In the first half of 2025, Leo Group's machinery manufacturing business segment continued to strengthen its global presence, steadily advancing its regional strategy by deepening its presence in mature markets and expanding into emerging markets. Leveraging its leading technology and superior product quality, it is gradually meeting the needs of various industries for efficient, intelligent, and green pump system solutions. During the reporting period, Leo Group successfully won the bid for the "South China Sea Regional Water Injection Pump Skid Procurement Annual Agreement Project," achieving a technological breakthrough in key high-end equipment for upstream processes on offshore platforms and demonstrating its exceptional technical strength in high-end manufacturing.

Concurrently, Leo Group actively expanded into the nuclear power sector. In June, Leo Pumps, the United Nuclear Power Planning and Design Institute, Sanmen Nuclear Power Co., Ltd., Zhejiang University, and Xiangtan Electric Motor Co., Ltd. jointly signed a framework agreement for the joint development of large-scale adjustable-flow circulating water pumps for nuclear power plants. The successful progress of this R&D project is expected to achieve breakthroughs in key technologies for adjustable-blade circulating water pumps in China, addressing related technical shortcomings, and further enhance the competitiveness of the industry chain and the safety of the nuclear power supply chain.

Southern Pump Industry

Southern Pump Industry achieved operating revenue of 2.271 billion yuan, a 3% year-on-year increase; net profit attributable to shareholders of the listed company was 169 million yuan, a 2.89% year-on-year increase, maintaining a steady and positive development trend.

Southern Pump Industry's manufacturing segment achieved revenue of approximately 2.027 billion yuan, a 6.99% year-on-year increase, and net profit attributable to shareholders of the parent company was approximately 220 million yuan, a 10.71% year-on-year increase.

In the first half of 2025, Southern Pump Industry, centered around the goal of high-quality development, focused on its core pump manufacturing business, deepened reform and innovation, improved operational efficiency, and optimized its business structure. This resulted in significant progress in expanding overseas markets, further enhancing its core competitiveness and sustainable development capabilities. At the same time, Southern Pump Industry completed its merger and acquisition and name change, changing its full Chinese name to "Southern Pump Industry Co., Ltd." and its stock abbreviation to "Southern Pump Industry."

The intelligent manufacturing segment implemented a strategy of "strong growth, strong R&D, strong cost reduction, and strong transformation," introducing automated production lines, increasing investment in high-end pump R&D, and completing the development of numerous new products and process improvements, driving the high-end, intelligent, and energy-efficient nature of its products.

Southern Pump Industry accelerated its overseas market expansion, optimized its sales system, and established pilot overseas offices in selected regions. Its North American subsidiary, TFS, developed pumps for liquid cooling, and its European subsidiary, Hydroo, jointly developed a high-efficiency water pump series. Overseas revenue reached 436 million yuan in the first half of 2025, a year-on-year increase of 15.79%.

Southern Pump Industry strengthened its R&D investment, spending 114 million yuan in the first half of 2025, a year-on-year increase of 10.7%, accelerating new product development and technology application.

Beihua Chemical Industry Co., Ltd.

In the first half of 2025, Beihua Chemical Industry Co., Ltd. achieved revenue of 1.131 billion yuan, a year-on-year increase of 23.82%, and profit attributable to the parent company of 107 million yuan, a year-on-year increase of 207.91%.

Xiangyang 525 Pump Industry Co., Ltd., a subsidiary of Beihua Chemical Industry Co., Ltd., boasts over 40 years of experience in slurry pump R&D and manufacturing, and advantages in core material casting. Its products are widely used in the phosphorus chemical industry, flue gas desulfurization, mining, and metallurgy, and it holds a leading position in the flue gas desulfurization and phosphorus chemical pump market segments.

Xiangyang 525 Pump Industry Co., Ltd. is a high-tech enterprise in Hubei Province, and its "Special Industrial Pump" is a well-known Chinese trademark. In the first half of 2025, Xiangyang 525 Pump Industry Co., Ltd. achieved sales revenue of 350 million yuan, a year-on-year increase of 11.54%, and net profit of 4.6612 million yuan, a year-on-year decrease of 77.64%.

Xiangyang 525 Pump Industry Co., Ltd., a member of the third batch of national "Little Giant" enterprises designated as specialized, sophisticated, and innovative, a national manufacturing champion, and a national intellectual property advantage enterprise, has been designated a national industrial design center. Focusing on its "high efficiency, diverse product range, and intelligent" product upgrade strategy, the company actively researches and develops new special materials and cutting-edge technologies. Its development of a medium- and high-temperature slurry preheater feed pump fills a domestic gap. Appraised by the China General Machinery Association, the product's performance reaches internationally advanced levels, with some indicators reaching internationally leading levels. The company is also promoting the development of new products such as ceramic pumps, establishing a diversified portfolio of specialized industrial pumps.

Based on the company's digitalization requirements, the company integrates the characteristics of its online monitoring products with the industry's demand for online equipment safety monitoring to promote the application of online monitoring products. These products meet the needs of intelligent pump operation and remote monitoring, facilitating the development of integrated pump systems and gradually shifting from stand-alone equipment production to integrated units featuring "pump + start/stop control + remote monitoring + adaptive regulation." The company has been approved to establish a postdoctoral research workstation and has passed the review for the national "Little Giant" enterprise designation as a specialized, sophisticated, and innovative enterprise, earning one National Excellent Quality Trustworthy Team designation. "Research and Development of Multi-stage Heavy-Duty Slurry Pumps for High-Temperature, High-Pressure, and Abrasion-Resistant Working Conditions" won the third prize of the Group's Science and Technology Progress Award in 2025.

Dayuan Pump Industry

Dayuan Pump Industry focuses on two product lines: civil pumps and shielded pumps, covering the civil water pump, household pump, and industrial markets.

In the first half of 2025, Dayuan Pump Industry's operating revenue reached 965 million yuan, a year-on-year increase of 14.55%. This was primarily due to the recovery of its traditional business and the rapid development of its new commercial mechanical pumps and electric cooling pumps businesses. Its revenue has maintained steady growth in recent years.

Its agricultural pumps saw a nearly 20% year-on-year growth in the first half of the year. While household pumps primarily depend on the progress of Europe's recovery, domestic sales were weak in the first half of the year, maintaining overall stable development.

New businesses such as commercial mechanical pumps and liquid cooling pumps maintained strong growth from a low base. The main growth point for industrial pumps this year is in overseas markets. If foreign trade develops well in the second half of the year, overall stability is expected.

A notable highlight was that Dayuan Pump Industry's energy-saving pumps for household pumps saw sales increase by approximately 20% year-on-year in the first half of the year.

Dayuan Pump Industry stated that energy-saving pumps remain a relatively certain development trend, both domestically and internationally. Previously, sales were primarily focused on overseas markets, but this year, feedback from sales outlets indicates that demand for energy-saving pumps is also emerging in the domestic retail market.

Liquid cooling pumps are also a key focus for Dayuan Pump Industry. Technically, due to the hot and cold cycles involved, liquid temperatures can reach 80°C to 90°C, requiring high technical complexity in permanent magnet motors, electronic controls, and hydraulic design. The liquid cooling pump market is a niche market with relatively few early entrants, but early adopters have a certain advantage based on their application scenarios and technological expertise. From a service perspective, the liquid cooling industry has seen increasing popularity since last year, with rapid product iterations. While overseas suppliers offer mature and highly consistent solutions, domestic manufacturers are more closely aligned with the supply chain and possess the ability to respond quickly and iterate. The value of data center liquid cooling pumps can be compared to overseas NV chain water pumps, but as the supply chain becomes more localized, price and quality will gradually improve. Dayuan Pump Industry currently prioritizes customer engagement, focusing on leading downstream temperature control manufacturers, accelerating product iteration based on their needs, and simultaneously promoting terminal certification and adaptation.

In the future, Dayuan Pump Industry will focus on developing mid-to-high-end products in the industrial field; increase investment in businesses with low international market share but good cash flow, such as the European HVAC market; and focus on team configuration and resource investment in new businesses such as commercial pumps and liquid cooling pumps due to their broad market space and great growth potential.

Lingxiao Pump Industry

In the first half of 2025, Lingxiao Pump Industry achieved operating revenue of 840 million yuan, an increase of 11.57% year-on-year; and net profit attributable to shareholders of the listed company of 234 million yuan, a year-on-year increase of 7.78%. Of this total, domestic sales amounted to 386 million yuan, a year-on-year increase of 17.90%, and international sales amounted to 454 million yuan, a year-on-year increase of 6.71%.

Lingxiao Pump Industry has undertaken National Torch Program projects and participated in the development and revision of one national standard, four industry standards, and five group standards, including "Test Methods for Single-Phase Asynchronous Motors," "Barrier-Free Door-Opening Water-Jet Massage Bathtubs," and "Intelligent Constant-Temperature Leisure Pools." The company boasts a provincial-level enterprise technology center, a provincial-level electric pump engineering technology research and development center, and a testing center accredited by the China National Accreditation Service for Conformity Assessment (CNAS). The company boasts strong scientific research capabilities and is capable of independently conducting environmental simulation testing and witness testing certifications such as those from Germany's TUV, the EU's CB, the US's UL, and the US's Energy Star WTDP.

Some of Lingxiao Pump Industry's civilian centrifugal pumps have reached internationally advanced levels in quality and performance. Numerous products have received high-tech product certification, and the company holds 18 invention patents. In terms of industry-university-research collaboration, the company maintains a long-term and stable partnership with Guangdong University of Technology, continuously enhancing its technological innovation capabilities and product added value.

In the first half of 2025, Lingxiao Pump Industry intensified its efforts to expand into the European and Southeast Asian markets. By product category, plastic sanitary pumps saw an 8.26% year-on-year increase, while stainless steel pumps saw a 17.69% year-on-year increase.

Junhe Co., Ltd.

In the first half of 2025, Junhe Co., Ltd. achieved operating revenue of 578 million yuan, a year-on-year increase of 5.53%. Net profit attributable to parent company shareholders was 30.9993 million yuan, a year-on-year decrease of 19.53%. The decline in net profit was primarily due to increased investments in the construction of its production base in Thailand and the expansion of cross-border e-commerce channels.

Faced with uncertainties in the international trade environment, Junhe Co., Ltd. continues to advance its global production capacity layout. During the reporting period, construction of its production base in Thailand accelerated, with factory construction commencing. Full-scale production is expected to begin in November 2025. The company has already begun trial production in a leased factory in Thailand and has secured its first orders. The launch of this facility will provide strong support for performance growth in 2026. Simultaneously, the company has launched its Malaysia business expansion, further strengthening its global market network and deepening its globalization strategy.

In terms of channel expansion, Junhe Co., Ltd. continues to strengthen its proprietary brand. By expanding its online marketing team and actively developing cross-border e-commerce, Junhe Co., Ltd.'s online brand sales on platforms such as Amazon have seen rapid growth, reaching 62.03 million yuan in revenue, an increase of approximately 400% year-on-year, becoming a new highlight of its performance growth.

Also, the company is steadily advancing the construction of its "Junhe Hardware and Electrical Warehousing Center." In the first half of the year, new warehousing centers were opened in Lhasa, Guiyang, Harbin, Changsha, Linyi, and Wuhan, bringing the total number of its one-stop warehousing centers in China to 13, covering multiple regions including East China, South China, Southwest China, and North China.

In terms of R&D and innovation, Junhe Co., Ltd. continues to increase its investment, with R&D expenses reaching 13.7977 million yuan in the first half of 2025, driving product upgrades and technological iterations. Of particular note is the company's active deployment in high-growth emerging sectors. Junhe Co., Ltd. is also closely monitoring the explosive growth of the liquid cooling industry, initiating systematic development of products such as liquid cooling pumps, establishing a dedicated R&D team, and planning collaborative development with downstream customers to accelerate its entry into new markets.

Weipaige

In the first half of 2025, Shanghai Weipaige Smart Water Co., Ltd. achieved operating revenue of 331 million yuan. Net profit attributable to the parent company, excluding non-recurring items, was a loss of 90.22 million yuan, a narrower loss than the 93.30 million yuan loss in the same period last year, representing a significant improvement in the magnitude of the loss.

Weipige specializes in providing full-chain smart water solutions from source to user. Its business covers smart water plants, smart water services, and smart water supply. It also manufactures and sells water supply equipment, smart water meters, and direct drinking water equipment. Its major customers include major domestic water groups, water conservancy bureaus, water bureaus, and water companies.

Despite a year-on-year decline in overall revenue, the company's revenue structure remains focused on its core businesses. Smart water supply, smart water services, and smart water plants form the core of its performance, generating revenues of 155 million yuan, 72 million yuan, and 39 million yuan, respectively.

As a leading company in China's smart water industry, Weipaige has consistently adhered to its mission of "Devoting Ourselves to Water, A Green Future." It has thoroughly implemented the principles of the Industrial Internet, continuously innovating technologies, products, and services, continuously enhancing the core competitiveness of its core business, and promoting high-quality development.

It has extensive technical expertise in AI, the Internet of Things, big data, and cloud computing. Seizing opportunities in generative AI, the company has launched a number of innovative products and implemented them in practical applications. Its "Weipaige River Map AI Platform," integrating large-scale modeling technology, enables intelligent forecasting and decision-making support for water systems, helping water companies achieve refined management and intelligent operations.

Notably, at the end of the reporting period, Weipaige's backlog increased by 149 million yuan compared to the same period last year, demonstrating its strong market expansion capabilities. In the second half of the year, Weipaige will continue to deepen cost reduction and efficiency improvements, enhance operational efficiency, strengthen financial stability, and strive to improve operating performance and achieve a turnaround.

Taifu Pump Industry

In the first half of 2025, Taifu Pump Industry achieved operating revenue of 425 million yuan, a year-on-year increase of 10.95%. Net profit attributable to shareholders of the listed company was 23.3342 million yuan, a year-on-year decrease of 19.26%. Net profit after deducting non-recurring gains and losses was 18.7063 million yuan, a year-on-year decrease of 26.28%.

Of this total, overseas revenue was 319 million yuan, a year-on-year decrease of 9.67%, primarily due to reduced purchasing demand from customers in Bangladesh and the United States. Domestic revenue reached 107 million yuan, a significant year-on-year increase of 247.26%, demonstrating significant success in expanding the domestic market.

From a product perspective, onshore pumps, energy-saving pumps, and circulating pumps all achieved steady growth. Energy-saving pumps (particularly solar water pumps) significantly increased their revenue while maintaining a high gross profit margin. This was due to continuous product upgrades and optimization of key components, which enhanced product competitiveness while effectively reducing manufacturing costs.

Revenue from well submersible pumps and small submersible pumps declined. Small submersible pumps are primarily sold to the United States. The decline in revenue was primarily due to international trade frictions, resulting in shipment suspensions.

Taifu Pump Industry stated that it will continue to pursue its external expansion strategy and plans to further enhance the listed company's overall competitiveness and sustainable development capabilities through mergers and acquisitions, restructuring, and other means.

Aerospace Power

In the first half of 2025, Aerospace Power achieved total operating revenue of 328 million yuan, a year-on-year decrease of 12.88%. Net profit attributable to shareholders of the listed company was a loss of 73.1243 million yuan, an increase from a loss of 56.926 million yuan in the same period last year. Net profit after deducting non-recurring gains and losses was a loss of 67.7349 million yuan, also an increase year-on-year.

Aerospace Power primarily engages in the research and development, production, and sales of pumps, pump systems, and hydraulic transmission systems, as well as the contracting of engineering projects. The decline in operating income was primarily due to multiple factors: First, intensified competition in the motor industry led to a decline in motor product revenue; second, while large hydraulic pumps maintained a strong performance, they declined year-on-year, and the longer settlement cycles for major projects impacted current-period revenue recognition; third, the company proactively adjusted its product mix, reducing its portfolio of lower-gross-margin oil pumps and chemical pumps, and actively promoting business transformation and upgrading.

Aerospace Power's profitability was under pressure due to declining revenue and the investment required during the transformation period. Future performance improvement will depend on the success of expanding high-value-added products and the implementation of its transformation strategy.

4. Outlook for the Second Half of 2025

A review of the first-half 2025 performance of nine listed pump companies, including Southern Pump, Dayuan Pump, Lingxiao Pump, Junhe Co., Ltd., Taifu Pump, Weipaige, and Aerospace Power, reveals an overall trend of "slowing revenue growth and generally pressured profits."

In terms of revenue, some companies, such as Southern Pump (+3%), Dayuan Pump (+14.55%), Lingxiao Pump (+11.57%), and Taifu Pump (+10.95%), achieved varying degrees of growth, demonstrating market resilience. However, some companies, such as Aerospace Power (-12.88%) and Weipaige (revenue decline), experienced revenue declines due to macroeconomic factors, project settlement cycles, or strategic adjustments.

In terms of profitability, most companies experienced year-on-year net profit declines. Even with revenue growth, margin pressures were often driven by increases in raw material costs, new base construction, and R&D investment. This reflects the increasingly fierce competition in the industry and the squeeze on profit margins.

It's worth noting that, faced with slowing growth in traditional markets and fierce competition, companies are actively seeking breakthroughs, and establishing new markets has become a common strategic direction. Liquid cooling pumps, as a high-growth emerging sector, have been explicitly identified as a development priority by numerous companies, including Southern Pump Industry, Dayuan Pump Industry, and Junhe Co., Ltd. They are investing in R&D, building teams, and securing key clients to seize technological and market opportunities.

At the same time, companies are continuously optimizing their business strategies: on the one hand, they are mitigating trade risks and gaining closer proximity to the end market through global production capacity deployment (such as Junhe Co., Ltd.'s Thailand factory and Taifu Pump Industry's Vietnam factory); on the other hand, they are strengthening their own brands and expanding their channels to lower-tier markets (such as Junhe Co., Ltd.'s cross-border e-commerce and warehousing center development) to improve service responsiveness and customer loyalty.

Overall, the pump industry will forge ahead amidst challenges in the first half of 2025. Future growth depends not only on stable operations in traditional markets but also on technological breakthroughs in emerging sectors like liquid cooling, the effectiveness of their global expansion, and the improvement of refined management capabilities.

1.The news above mentioned with detailed source are from internet.We are trying our best to assure they are accurate ,timely and safe so as to let bearing users and sellers read more related info.However, it doesn't mean we agree with any point of view referred in above contents and we are not responsible for the authenticity. If you want to publish the news,please note the source and you will be legally responsible for the news published.

2.All news edited and translated by us are specially noted the source"CBCC".

3.For investors,please be cautious for all news.We don't bear any damage brought by late and inaccurate news.

4.If the news we published involves copyright of yours,just let us know.

Next Sheyang Port Power Plant Project supported by Daton Powerfan Fan System Honored as China High-Quality Electric Power Project

BRIEF INTRODUCTION

Cnbearing is the No.1 bearing inquiry system and information service in China, dedicated to helping all bearing users and sellers throughout the world.

Cnbearing is supported by China National Bearing Industry Association, whose operation online is charged by China Bearing Unisun Tech. Co., Ltd.

China Bearing Unisun Tech. Co., Ltd owns all the rights. Since 2000, over 3,000 companies have been registered and enjoyed the company' s complete skillful service, which ranking many aspects in bearing industry at home and abroad with the most authority practical devices in China.