The Future Development Trends of the Hydraulic Industry

"Small Size, Big Power": The Evolution and Future Speculation of Hydraulic Technology

1. Overview of Hydraulics

During the Second Industrial Revolution, machines powered by internal combustion engines and electricity began to be widely used. These machines were widely used to replace manual labor and significantly improved production efficiency. Early machines were usually driven directly by a prime mover to complete the work. With technological advancements, machine structures became increasingly complex, and prime movers could no longer directly meet the diverse needs of actuators in terms of speed, force, torque, or motion. Therefore, most modern machinery requires adjustment and control through intermediate links (i.e., transmission and control systems).

Hydraulic transmission uses liquid as the working medium. The mechanical energy of the prime mover is converted into the pressure energy of the liquid through a drive device, and then the pressure energy is converted back into mechanical energy through pipes and control elements to drive the actuator to achieve linear or rotary motion. Compared with traditional mechanical transmission, hydraulic transmission has advantages such as light weight, small size (under the same pressure conditions, the volume of a mechanical transmission device is usually 5 to 7 times that of a hydraulic transmission device), flexible layout, low inertia, fast response speed (10% to 20% faster than mechanical transmission), convenient operation, and ease of automation. 2. Development of the Hydraulic Industry

2. Development of the Hydraulic Industry

(1) Global Development of the Hydraulic Industry

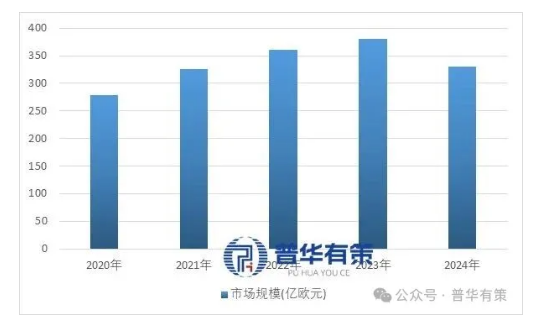

Hydraulic transmission is an important form of transmission in modern industry. Since the invention of the first hydraulic press by the Englishman Bramer in 1795, which opened up engineering applications, the industry has undergone continuous technological iteration and upgrading. This included the qualitative breakthrough in 1905 when the working medium was changed from water to oil, the application of electro-hydraulic servo control technology in the 1940s, the birth of electro-hydraulic proportional control technology in the 1960s, and the development towards high pressure, large flow, and integration from the 1970s to the present. From 2010 to 2024, the global hydraulic industry market size grew from approximately €21.2 billion to €33.1 billion, with a compound annual growth rate of 3.23%. Although there were temporary declines due to the weakening international economic environment in 2020 and macroeconomic and geopolitical factors in 2024, the overall trend was one of "spiral" upward movement.

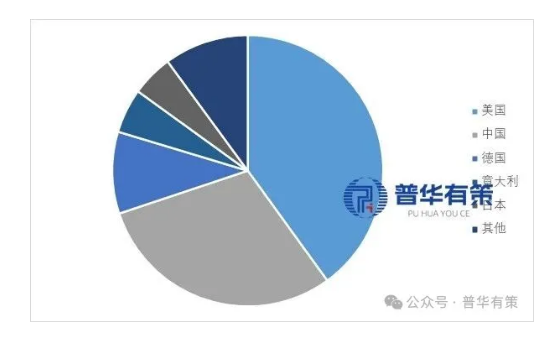

In 2024, the sales volume of hydraulic products in the United States, China, Germany, Italy, and Japan accounted for 40.02%, 29.87%, 9.76%, 5.31%, and 4.97% of the global market, respectively. Among them, the market size of the hydraulic industry in the United States and China significantly outpaced that of Germany, Italy, Japan, and other European countries, and China has become the world's second largest hydraulic market.

The market size of the hydraulic industry is significantly positively correlated with a country's total economic output and level of industrialization. Globally, the United States, China, Germany, Italy, and Japan rank among the top five in hydraulic sales. The combined market size of the US and China accounts for more than two-thirds of the total global hydraulic industry.

(2) Development of China's Hydraulic Industry

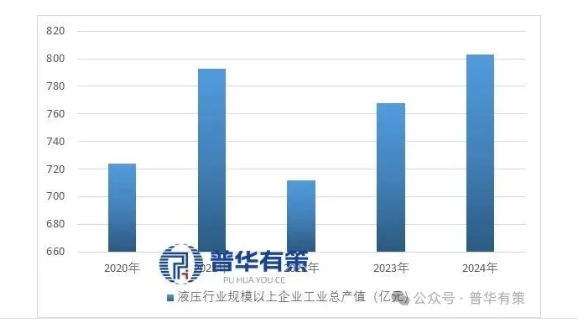

my country's hydraulic industry started in the 1950s with the imitation of Soviet machine tool hydraulic transmission, and hydraulic components were produced in the hydraulic workshops of machine tool factories. In the 1960s and 1970s, the technology continued to develop and the application fields expanded to agriculture and engineering machinery, etc., and the hydraulic workshops became independent professional production plants, and the industry entered a stage of professional growth. In the 1980s and 1990s, with the help of reform and opening up, it received support from many aspects and entered a period of rapid development. From the 21st century to the present, it has entered a mature development stage, relying on the rapid development of various equipment manufacturing industries to move forward steadily. From 2015 to 2024, the total industrial output value of enterprises above designated size increased from RMB 52.2 billion to RMB 80.3 billion, with a compound annual growth rate of 4.90%.

my country's hydraulic industry market size grew from 58.3 billion yuan in 2015 to 77.1 billion yuan in 2024. During this period, the industry experienced a sustained recovery from 2015 to 2021, followed by a decline in 2022 due to the downturn in the construction machinery industry. Growth resumed in 2023 with the recovery of the macroeconomy, increasing by 8.09%, but declined by 2.16% in 2024 due to weak fixed asset investment and consumer demand, as well as intensified industry competition.

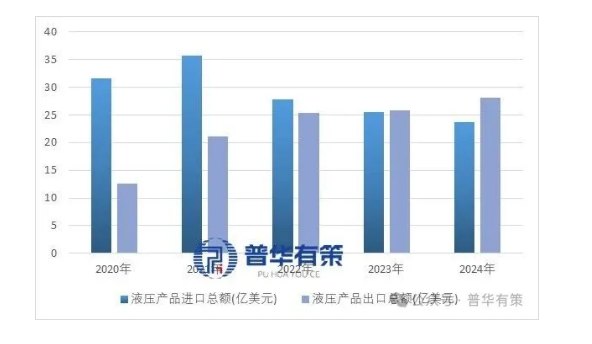

Chinese domestic hydraulic companies lag significantly behind advanced foreign companies in technology, innovation, and R&D. Their products are mostly positioned at the low to mid-end of the value chain, with high-end components relying heavily on imports. From 2022 to 2024, the import value of hydraulic products decreased year by year (2.78 billion, 2.56 billion, and 2.37 billion USD), while exports steadily increased (2.54 billion, 2.59 billion, and 2.82 billion USD). A trade surplus was achieved in 2023, but imports were mainly high-value-added hydraulic valves and pumps, while exports were primarily low-value hydraulic cylinders.

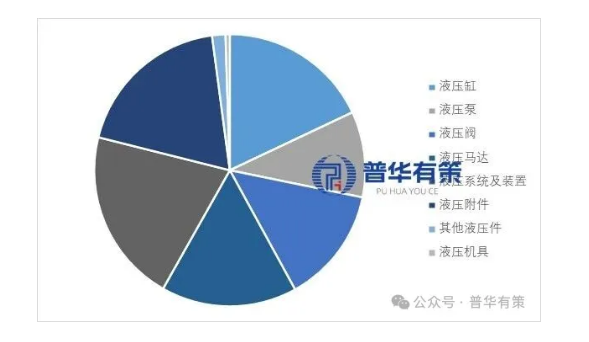

In 2024, the distribution of production value among key enterprises in my country's hydraulic industry was as follows: hydraulic systems, hydraulic cylinders, hydraulic motors, hydraulic valves, and hydraulic pumps accounted for 20.70%, 18.00%, 16.20%, 13.80%, and 10.20% respectively. Among these, products with higher technological barriers and higher added value, such as hydraulic valves and hydraulic pumps, had a relatively low proportion of production value. These two product categories are also key areas for China's hydraulic industry to achieve breakthroughs in domestic production.

3. Development Prospects of the Hydraulic Industry

Looking ahead to the 15th Five-Year Plan period, China's hydraulic industry has broad development prospects, with structural opportunities and strategic value becoming increasingly prominent. The primary opportunity lies in import substitution in high-end fields. Currently, core components such as high-pressure hydraulic pumps and valves still heavily rely on imports, which has become a critical link in the security of the national industrial and supply chains. Driven by the "independent and controllable" strategy, breaking through these "bottleneck" technologies will be of paramount importance, providing a huge market substitution space for domestic enterprises with technological strength. Secondly, new application scenarios and business models will continue to emerge. The deep integration of AI and hydraulics will spur its large-scale application in emerging fields such as industrial robots, unmanned construction machinery, and smart agriculture. Furthermore, the industry's value focus will shift from single hardware sales to providing overall solutions of "hardware + software + services," with data-driven remote operation and maintenance, energy efficiency management, and other value-added services becoming new profit growth points. In conclusion, facing multiple challenges such as technology, talent, and competition, those enterprises that can closely follow national policies, embrace intelligence, and deeply cultivate core technologies will have the greatest potential to occupy a dominant position in the future landscape and share the rich dividends brought by industrial upgrading.

4. Future Development Trends of the Hydraulic Industry

During the 15th Five-Year Plan period, the development trend of China's hydraulic industry will present a systemic upgrade driven by both policy and technology. Guided by the "Suggestions on the 15th Five-Year Plan for National Economic and Social Development," the industry will completely abandon extensive growth and shift towards a high-quality development path centered on high reliability, intelligence, green technology, and mechatronics integration. High reliability is the foundation and prerequisite, aiming to solve the long-standing pain points of short lifespan and poor stability of domestically produced hydraulic components, and is the cornerstone for achieving import substitution and winning market trust. Intelligence is the core engine; the integration of artificial intelligence (AI) technology will transform hydraulic systems from passive execution components into intelligent units with perception, decision-making, and adaptive capabilities, enabling predictive maintenance, optimal energy-efficiency control, and automated operation and maintenance, greatly enhancing equipment value and user experience. Simultaneously, under the constraints of "dual carbon" targets, green technology has become a mandatory requirement, driving continuous innovation in areas such as low noise, leak-free operation, energy saving, and environmentally friendly media. These trends are not isolated but intertwined and deeply integrated, jointly shaping a new form of the hydraulic industry with higher technological barriers, greater added value, and better meeting the needs of modern high-end equipment. The main development directions and trends of the hydraulic industry are analyzed as follows:

(1) High Reliability

Hydraulic technology has been widely used in various industrial equipment. The reliability of hydraulic components directly affects the working stability of hydraulic devices and even the entire mechanical equipment. Therefore, high reliability is not only an important goal for the continuous improvement of hydraulic technology, but also a key factor for related products to gain an advantage in market competition. For a long time, domestic hydraulic products have suffered from insufficient reliability, low stability, and short service life, resulting in a large reliance on imports by main engine manufacturers and end users. The low reliability of hydraulic components has become a major bottleneck restricting the development of my country's hydraulic industry. Against this backdrop, improving the reliability of hydraulic components will become the key to the future development of the industry.

(2) Lightweighting and Miniaturization

As a key component of the transmission system, hydraulic components need to be used in conjunction with downstream main engine equipment to achieve power transmission and intelligent control. Lightweighting helps reduce rotational inertia, improve dynamic response performance, reduce energy consumption, and extend the endurance and service life of main engine equipment; miniaturization is conducive to improving the response speed of the hydraulic system. In the future, through precise design and high integration of flow channels and internal structures, meeting the stringent requirements of downstream equipment for product size and weight while ensuring performance will become an important trend in the development of hydraulic components.

(3) Mechatronics Integration and Integration

Mechatronics integration can fully leverage the advantages of hydraulic transmission, such as large output force, low inertia, and fast response, driving the system to transform from traditional electro-hydraulic open-loop control and open-loop proportional control to closed-loop proportional servo systems, and realizing automatic monitoring and diagnosis of parameters such as pressure, flow rate, position, temperature, and speed. High-frequency, low-power electronic control components combined with computer technology can construct high-level information control systems, thereby reducing the debugging and maintenance costs of hydraulic systems. Mechatronics integration is also the technological foundation for realizing the intelligentization of hydraulic products in high-end equipment manufacturing. Therefore, the development of hydraulic products towards mechatronics integration and integration has become an inevitable trend in the industry's future. (4) Intelligentization

The future development of mechanical equipment requires, on the one hand, improved operational safety and reduced labor intensity. Therefore, operating systems must be easy to operate, have user-friendly human-machine interfaces, and even be automated and unmanned. On the other hand, to improve equipment reliability, extend service life, reduce maintenance time, and lower labor costs, operating systems also need to have status monitoring, fault diagnosis, and intelligent maintenance capabilities. The hydraulic industry must continuously improve its level of intelligence to meet the operation and maintenance needs of downstream main equipment. Therefore, the application of intelligent technology throughout the entire life cycle of hydraulic components will become an important direction for the future development of the industry.

(5) Greening

Increasingly stringent environmental regulations and the upgrading and transformation of downstream industrial technologies have placed higher demands on the energy conservation and environmental protection of hydraulic components and parts, especially in terms of low energy consumption, low noise, low vibration, no leakage, and pollution control, which must meet environmental standards. Currently, hydraulic components still face challenges such as process pollution, vibration and noise, material loss, and media leakage during manufacturing and use. In the future, integrating the concept of green manufacturing into the entire life cycle of product design, process, manufacturing, use, and recycling to achieve low-carbon, energy-saving, emission-reduction, and environmentally friendly goals has become a strategic requirement for the sustainable development of the hydraulic industry.

1.The news above mentioned with detailed source are from internet.We are trying our best to assure they are accurate ,timely and safe so as to let bearing users and sellers read more related info.However, it doesn't mean we agree with any point of view referred in above contents and we are not responsible for the authenticity. If you want to publish the news,please note the source and you will be legally responsible for the news published.

2.All news edited and translated by us are specially noted the source"CBCC".

3.For investors,please be cautious for all news.We don't bear any damage brought by late and inaccurate news.

4.If the news we published involves copyright of yours,just let us know.

Next 2025 Oct Key Metallurgical Products Import and Export Bulletin

BRIEF INTRODUCTION

Cnbearing is the No.1 bearing inquiry system and information service in China, dedicated to helping all bearing users and sellers throughout the world.

Cnbearing is supported by China National Bearing Industry Association, whose operation online is charged by China Bearing Unisun Tech. Co., Ltd.

China Bearing Unisun Tech. Co., Ltd owns all the rights. Since 2000, over 3,000 companies have been registered and enjoyed the company' s complete skillful service, which ranking many aspects in bearing industry at home and abroad with the most authority practical devices in China.