Overview of China General Machinery Industry in H1 2025

In the first half of 2025, amid a complex and severe external environment, China's macroeconomy demonstrated strong resilience and vitality, with GDP growing by 5.3% year-on-year—0.3 percentage points higher than the same period last year and the full year of 2024. Against this backdrop, the general machinery industry maintained a stable and improving operational trend, with key indicators such as revenue and profit achieving year-on-year growth. Exports exceeded expectations, and significant progress was made in promoting industrial restructuring through innovation-driven initiatives and green transformation, leading to continued improvement in the industry's economic performance.

I. Industry Economic Performance

1. Stable and Improving Overall Operation

In the first half of the year, the general machinery industry exhibited a stable and improving operational trend. Driven by existing policies and the expanded scope of new initiatives targeting "new types of infrastructure and key projects," domestic market demand improved, contributing to a better overall development outlook compared to the same period last year. Revenue, profits, and output of major products in the general machinery industry all achieved year-on-year growth.

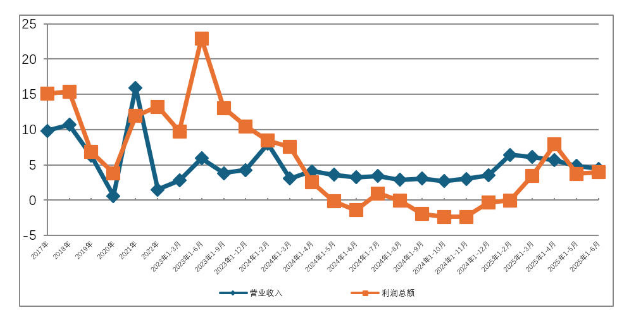

According to data from the National Bureau of Statistics, 8,842 industry enterprises above the designated size achieved operating revenue of 521.815 billion yuan, a year-on-year increase of 4.45%. Although this growth rate was 1.95 percentage points lower than the national industrial average and 3.35 percentage points lower than the machinery industry as a whole, the industry's revenue growth exceeded levels from the same period last year and the full year of 2024. The total profit reached 36.598 billion yuan, a year-on-year increase of 3.95%, which was 5.75 percentage points higher than the national industrial average but 5.45 percentage points lower than the machinery industry. After reversing the year-on-year decline in the first quarter, the total profit continued to grow in the second quarter, with a slightly accelerated growth rate compared to the end of the first quarter.

In terms of product output, data from the National Bureau of Statistics shows that in the first half of the year, the production of six key products in the general machinery industry—pumps, fans, gas compressors, valves, gas separation and liquefaction equipment, and speed reducers—all achieved year-on-year growth. However, the growth rate slowed significantly compared to the end of the first quarter. While five of these products (pumps, fans, gas compressors, gas separation and liquefaction equipment, and speed reducers) saw double-digit growth in the first quarter, by the end of the second quarter, only gas separation and liquefaction equipment and blowers maintained double-digit growth. The growth rates of the other key products declined to below 10%.

National Industrial and Machinery Industry Performance:

According to the National Bureau of Statistics, in the first half of the year, the value-added output of industrial enterprises above the designated size nationwide increased by 6.4% year-on-year. Among these, mining grew by 6.0%, manufacturing by 7.0%, and the production and supply of electricity, heat, gas, and water by 1.9%. The equipment manufacturing industry saw a year-on-year increase of 10.2%, while high-tech manufacturing grew by 9.5%. The operating revenue of industrial enterprises above the designated size nationwide rose by 2.5%, but total profits decreased by 1.8% year-on-year. In the machinery industry, the value-added output of enterprises above the designated size increased by 9.0%—3 percentage points higher than the same period last year. Operating revenue grew by 7.8%, an increase of 6.8 percentage points year-on-year, while total profits increased by 9.4%, up by 13.1 percentage points compared to the same period last year.

2. Export Performance Exceeds Expectations

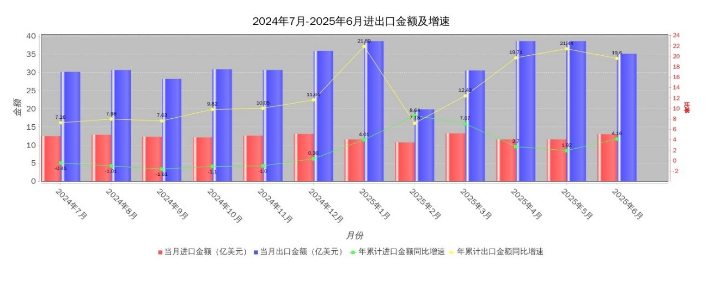

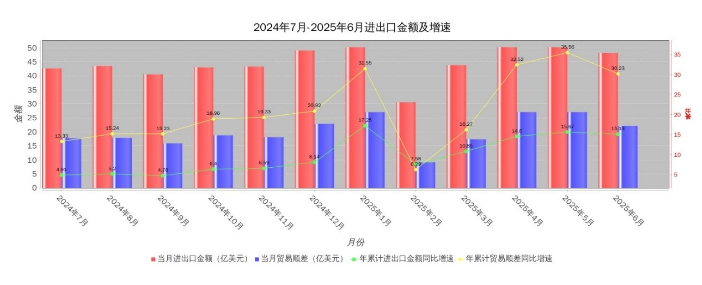

Amid the U.S. tariff war in the first half of the year, the general machinery industry achieved year-on-year growth in exports, imports, and trade surplus, with export performance surpassing expectations. The growth rates of export value and trade surplus accelerated significantly compared to the same period last year. The industry successfully countered the pressure of the new round of U.S. "tariff war," further strengthening its foreign trade resilience.

According to customs data, the total import and export value of 47 key products in the general machinery industry reached $27.31 billion in the first half of the year, a year-on-year increase of 15.13%. Specifically, imports amounted to $7.158 billion (up 4.16% year-on-year), while exports reached $20.152 billion (up 19.6% year-on-year). The trade surplus totaled $12.994 billion, reflecting a year-on-year growth of 30.23%.

The top ten countries or regions by export value for key general machinery products are: the United States, Russia, Indonesia, Vietnam, Japan, South Korea, Germany, India, the United Arab Emirates, and Thailand. Exports to the United States decreased by 3.89% year-on-year (compared to an 8.33% year-on-year increase at the end of the first quarter); exports to Russia increased by 15.69% year-on-year; and exports to Indonesia increased by 13.04% year-on-year. By region, exports to the 10 ASEAN countries increased by 17.26% year-on-year in the first half of the year; exports to the 27 EU countries increased by 7.47% year-on-year; and exports to the five Central Asian countries increased by 45.16% year-on-year.

The top ten countries or regions by import value are: Germany, Japan, the United States, Italy, South Korea, Switzerland, France, Sweden, the United Kingdom, and Malaysia. Imports from Germany increased by 0.71% year-on-year; imports from Japan increased by 12.87% year-on-year; and imports from the United States increased by 8.5% year-on-year (compared to an 11.73% year-on-year increase at the end of the first quarter), compared to a year-on-year decrease of 5.17% in the same period last year.

3. Key Contact Enterprises' Revenue and Profit Growth Rates Slower Than the Industry Average

According to statistics from the China Communications Association (CCA) on 210 key contact member enterprises, in the first half of the year, total industrial output value reached 68.614 billion yuan, a year-on-year decrease of 3.01%; operating income reached 62.321 billion yuan, a year-on-year increase of 0.8%; and total profits reached 5.744 billion yuan, a year-on-year decrease of 3.81%. Key contact enterprises' revenue and total profit growth rates fell below the industry average. The key contact enterprises included in the survey showed significant operational differentiation: approximately 49% of enterprises experienced year-on-year revenue growth, approximately 43% experienced year-on-year total profit growth, and approximately 78% of enterprises were profitable.

4. Innovation-Driven Achieves Fruitful Results

The industry is vigorously promoting scientific and technological innovation, resulting in a continuous emergence of scientific and technological achievements and accelerating their application. This is particularly evident in areas such as nuclear power and energy storage, resulting in the development of a number of important new products and technologies.

The "Guohe No. 2" canned motor main pump developed by Shenyang Blower Group passed engineering tests on its first attempt, meeting design requirements for key indicators such as hydraulic performance and idling performance. Two methanation waste heat recovery units independently developed and commissioned by the Tianhua Institute of Research and Development successfully started up and are now operating stably for a 5.5 billion standard cubic meter/year coal-to-natural gas project. Construction of the LNG cryogenic reliquefaction unit skid for LNG carriers, commissioned by the China Shipbuilding Industry Corporation's 711 Institute, has been successfully completed and entered the final verification phase.

In addition, several scientific and technological achievements have passed appraisal, including the main steam safety valve for the Hualong One nuclear power unit, a prototype of a shaft-sealed reactor coolant pump (Huapump-1) for a million-kilowatt nuclear power plant, a molten salt pump for solar thermal power generation and energy storage, a multi-stage integrated high-speed gearbox for supercritical carbon dioxide energy storage compressors, a multi-stage liquid ring shielded TEG exhaust gas compressor unit, and a low-energy four-tower radial bed pressure swing adsorption oxygen production system.

II. Difficulties and Challenges Facing Industry Development

1. The Market Still Faces Pressure from Insufficient Demand

Driven by a series of national policies, market demand for the general machinery industry improved significantly in the first half of the year. Production of six key product categories—pumps (including vacuum pumps), fans (including blowers), gas compressors, valves, gas separation and liquefaction equipment, and reducers—all achieved year-on-year growth. However, product output growth slowed in the second quarter, and industry revenue growth also decelerated compared to the first quarter. According to statistics from the association's survey of 210 key companies, approximately 51% of companies saw year-on-year growth in cumulative orders in the first half of the year, while approximately 49% saw a year-on-year decline. The industry will continue to face pressure from insufficient demand in the second half of the year.

2. Involutive Competition in the Industry Intensifies

Involutive competition in the general machinery industry is severe. Homogeneous competition in mid- and low-end products has led to price wars, severely squeezing companies' profit margins. Industry profit margins remain low, and R&D investment has been eroded by price wars, stifling innovation. There is an urgent need to study how to strengthen industry self-discipline, regulate corporate behavior, and maintain a fair competitive environment in the market.

3. Uncertainty in the Foreign Trade Market Remains Significant

Amidst the increasingly severe and complex external environment, rising global trade protectionism, escalating Sino-US trade frictions, and increasing uncertainty in the foreign trade market, industry players should pay close attention to the impact of the US tariff war on the world economy and global industrial chains and prepare countermeasures.

III. Development Outlook

2025 marks the final year of the 14th Five-Year Plan. In the first half of the year, the national economy rose to the occasion, maintaining stability and improving performance. New drivers of growth and development strengthened, and high-quality development achieved new progress, laying a solid foundation for a strong start to the 15th Five-Year Plan next year.

In the first half of the year, the country implemented a more proactive fiscal policy and a moderately accommodative monetary policy, introducing a series of policies to stabilize growth. More funds were allocated to support the implementation of the "two-pronged" and "two new" strategies, expanding domestic demand and boosting consumption. These policies involved key areas such as major infrastructure, major water conservancy projects, and new urban infrastructure.

The Political Bureau of the CPC Central Committee held a meeting in July this year to review the current economic situation and emphasized the need for sustained macroeconomic policy action and timely reinforcement. We will effectively leverage various structural monetary policy tools to strengthen support for technological innovation, boost consumption, and promote the development of small and micro enterprises. We will also address disorderly competition among enterprises in accordance with laws and regulations and promote capacity management in key industries. The Ministry of Industry and Information Technology will also soon issue a special work plan for stabilizing growth in the machinery and other industries, focusing on enhancing high-quality supply capacity, optimizing the industry development environment, and promoting effective qualitative improvement and reasonable quantitative growth.

With the implementation and further implementation of various national policies to stabilize the economy and growth, we expect the industry to maintain a stable and positive momentum in the second half of the year, ensuring a successful conclusion of the 14th Five-Year Plan.

1.The news above mentioned with detailed source are from internet.We are trying our best to assure they are accurate ,timely and safe so as to let bearing users and sellers read more related info.However, it doesn't mean we agree with any point of view referred in above contents and we are not responsible for the authenticity. If you want to publish the news,please note the source and you will be legally responsible for the news published.

2.All news edited and translated by us are specially noted the source"CBCC".

3.For investors,please be cautious for all news.We don't bear any damage brought by late and inaccurate news.

4.If the news we published involves copyright of yours,just let us know.

Next Southern Precision to Invest 366 Million Yuan in Precision Transmission Components and Industrial Bearings

BRIEF INTRODUCTION

Cnbearing is the No.1 bearing inquiry system and information service in China, dedicated to helping all bearing users and sellers throughout the world.

Cnbearing is supported by China National Bearing Industry Association, whose operation online is charged by China Bearing Unisun Tech. Co., Ltd.

China Bearing Unisun Tech. Co., Ltd owns all the rights. Since 2000, over 3,000 companies have been registered and enjoyed the company' s complete skillful service, which ranking many aspects in bearing industry at home and abroad with the most authority practical devices in China.